Insights Blog

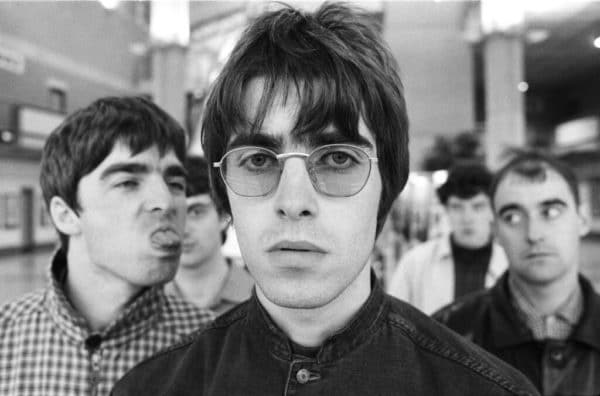

What Noel and Liam Gallagher Can Teach Us About Estate Planning

December 18, 2024 // Adam Bruderly

What Noel and Liam Gallagher Can Teach Us About Estate Planning

The news of Noel and Liam Gallagher reconciling and inspiring an Oasis reunion tour is proof that even the most fractured relationships can find a path back. But let’s be honest: family disputes don’t always end this way. For many, unresolved tensions and poor planning create divides that are never repaired.

The Gallagher brothers’ story highlights the challenges of managing family dynamics in the face of shared assets and legacies. Their reconciliation may bring joy to fans, but it’s also a powerful reminder of what’s at stake for families navigating inheritance, succession, and planning for the future.

Here’s what we can learn from their story to ensure your estate plan builds harmony rather than discord.

Communication Is Key

The Gallaghers’ public feuds are legendary. For years, their inability to communicate openly and effectively drove a wedge between them. In estate planning, miscommunication—or no communication—can have similar effects, leading to disputes, misunderstandings, and even legal battles.

What to Do:

- Hold open and transparent conversations with family members about your estate plan.

- Use family meetings to explain your intentions, address concerns, and set clear expectations.

- Work with an estate planning attorney to ensure your wishes are clearly documented and legally sound.

Communication doesn’t guarantee agreement, but it lays the foundation for understanding and prevents unnecessary conflict.

Plan for Business Succession

Oasis was more than a band—it was a business, and the lack of a clear succession plan contributed to its breakup. Shared businesses or legacy assets in families can face similar challenges when there’s no plan for leadership or ownership transitions.

What to Do:

- Include a detailed succession plan in your estate documents for any family business or shared legacy assets.

- Define who will inherit ownership, how decisions will be made, and what happens in the event of disputes or dissolution.

- Work with professionals to craft a plan that reflects the values and goals of your family.

A well-thought-out succession plan can ensure the business thrives while protecting relationships.

Professional Guidance Can Prevent Conflict

The Gallaghers’ reconciliation likely involved trusted mediators or advisors helping them navigate their differences. Similarly, estate planning often benefits from neutral professionals who can help manage emotions and ensure fairness.

What to Do:

- Engage estate attorneys, financial advisors, or family mediators to guide the process.

- Appoint a neutral executor or trustee to oversee the estate and reduce the risk of perceived bias among heirs.

- Use their expertise to identify potential conflicts and draft solutions proactively.

Professional guidance can be the difference between a family that grows closer and one that falls apart.

Customize Plans to Your Family’s Unique Dynamics

Noel and Liam are very different people with different personalities and needs—just like any family. Estate plans that take a one-size-fits-all approach often create more problems than they solve.

What to Do:

- Customize your estate plan to reflect the unique dynamics and needs of your family.

- Establish trusts for heirs with financial challenges or strained relationships.

- Use flexibility in your plans to account for future changes in family dynamics.

By tailoring your plan, you can balance fairness with the specific needs of each individual.

Legacy Is About More Than Money

Despite their personal differences, Noel and Liam’s music continues to inspire fans worldwide—it’s their enduring legacy. Similarly, your estate plan isn’t just about dividing assets; it’s about the values, memories, and intentions you leave behind.

What to Do:

- Consider writing an ethical will to pass down your values and life lessons alongside your financial assets.

- Use family meetings to share stories, traditions, and hopes for future generations.

- Include charitable giving or philanthropic goals in your estate plan to extend your legacy beyond your family.

Legacy isn’t just about what you leave; it’s about how you’re remembered.

Relationships Matter More Than Assets

Even with their history of conflict, Noel and Liam have always been brothers first. In estate planning, preserving relationships should take precedence over distributing wealth.

What to Do:

- Design an estate plan that fosters unity by addressing potential sources of conflict proactively.

- Appoint neutral parties to oversee the plan and ensure decisions are handled fairly.

- Focus on solutions that strengthen family ties, not just allocate assets.

At the end of the day, it’s the relationships—not the assets—that matter most.

Don’t Let Your Legacy “Fall Apart”

Oasis’s reunion is a story of redemption, reconciliation, and rebuilding a legacy. While not all family conflicts can resolve with a happy ending, a well-thought-out estate plan can prevent discord and ensure your family’s relationships remain strong.

At Journey Wealth, we believe estate planning is about more than financial security—it’s about preserving relationships and creating a legacy that lasts. Let’s work together to build a plan that reflects your values, honors your family’s unique story, and helps ensure the harmony you want for future generations.

Your legacy deserves to stand the test of time. Let’s make it happen.

Four Pillar Friday

Your weekly guide to thriving in every aspect of life—Physical, Mental, Spiritual, and Financial Wellness.

Four Pillar Friday

Your weekly guide to thriving in every aspect of life—Physical, Mental, Spiritual, and Financial Wellness.

Four Pillar Friday

Your weekly guide to thriving in every aspect of life—Physical, Mental, Spiritual, and Financial Wellness.