Insights Blog

The Intersection of Health and Wealth

Jun 19, 2023 // Adam Bruderly

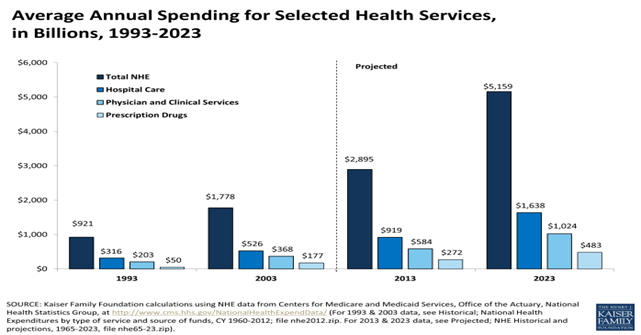

A recent study conducted by Fidelity found that healthcare and medical expenses for a 65-year-old retiring in 2021 are expected to surpass $300,000 throughout retirement. This represents a 30% increase from a decade ago and a staggering 88% rise from twenty years ago. The majority of financial plans address this issue by suggesting that individuals save more or work longer. However, incorporating exercise and nutrition into one’s lifestyle is an often-overlooked recommendation and perhaps would have the greatest impact on both your finances and your health.

At Journey, we uphold the principles of Purpose-Based Planning, which involves considering all dimensions of our clients’ lives and acknowledging the importance of addressing each one of them. Our philosophy is rooted in the belief that the three foundational pillars of wellness, namely mental, financial, and physical, constitute the bedrock for the life we aspire to have. We are steadfast in our belief that integrating exercise and nutrition into our clients’ strategies should not be a novelty, but a necessity. One that leads to a more profound sense of well-being that will last for generations to come.

Four Pillar Friday

Your weekly guide to thriving in every aspect of life—Physical, Mental, Spiritual, and Financial Wellness.

Navigating the "One Big, Beautiful Bill": Key Tax Proposals and Your Financial Future

Washington is abuzz over the newly passed “One Big, Beautiful Bill” Act—a sweeping House tax package that could reshape how Americans earn, save, and transfer wealth.

Mid-Quarter Market Commentary

Markets don't move in straight lines—and April was a vivid reminder. A resurgence of volatility rattled both stocks and bonds, with tariff tensions, lofty equity valuations, and shifting Fed expectations fueling uncertainty. Yet amid the noise, long-term fundamentals remain intact. At Journey Wealth, we believe these moments reinforce—not challenge—the value of a well-diversified portfolio grounded in your personal financial goals. From the resilience of international markets to the renewed attractiveness of fixed income, this month’s recap unpacks what’s driving market dynamics—and how thoughtful planning can help you stay on course through whatever comes next.