Insights Blog

The Future of Holistic Wealth Advice: More Than Just a Trend—It’s an Evolution

March 19th, 2025 // Adam Bruderly

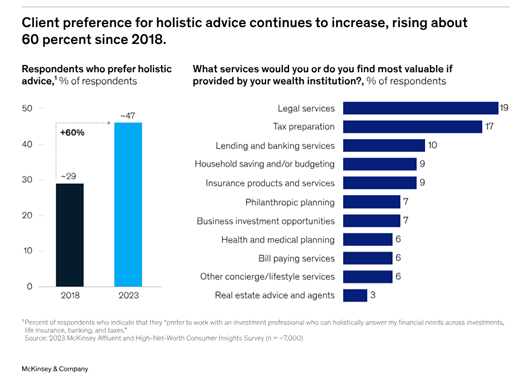

In just five years, the demand for holistic financial advice has surged 60%. A shift that signals something deeper than preference; it’s about expectations. At Journey Wealth, we see this as more than a trend—it’s a clear call to action for both ourselves and the financial industry to evolve.

Clients today no longer want siloed advice. They’re seeking a connected approach that doesn’t just optimize investments but aligns with their lives, goals, and overall well-being. The traditional advice model—primarily focused on portfolios, products, and cash flow—must expand to consider the full picture of financial and personal wellness

Expectations Will Continue to Grow. Is the Industry Ready?

This McKinsey study shows that clients want more than investment management—they’re seeking:

- Legal Services- 19%

- Tax Preparation- 17%

- Lending & Banking Solutions- 10%

- Household Budgeting & Savings Strategies- 9%

This signals a shift, but are we truly defining holistic wealth the right way?

Many in the industry still equate holistic advice with simply bundling services including legal, tax, lending, insurance, and business planning. While these are valuable, they still largely focus on financial mechanics rather than the experience of wealth.

But the word holistic comes from the Greek holos, meaning “whole” or “complete.” It refers to an approach that considers the entire system, not just individual parts. If we truly embrace this meaning, holistic wealth management must extend beyond financial services to address the full spectrum of well-being.

The Evolution of Wealth: Should Holistic Wellness Be in Your Portfolio?

We spend so much time optimizing for financial returns, but what about the additional components of well-being? If wealth is meant to serve our lives, shouldn’t holistic wellness be just as much a part of the portfolio as stocks, bonds, and alternative investments? Isn’t there a world where:

- Wellness is integrated into financial planning, with dedicated strategies for longevity, stress management, and cognitive health. Because a secure future is about more than just numbers.

- Time is treated as an investment, factored into financial planning to help clients optimize not just their wealth but how they spend their days.

- Health & longevity planning are considered alongside tax and estate strategies, ensuring clients aren’t just financially prepared for the future but physically and mentally prepared to enjoy it. What good is wealth without well-being?

What Will the Next 5 to 10 Years Bring?

If the demand for holistic wealth advice has grown 60% in just five years, where does that lead us next?

Will the financial industry continue focusing on services alone, or will it expand to truly reflect what people value most—health, time, and fulfillment? We believe the next evolution of financial advising isn’t just about optimizing portfolios—it’s about optimizing lives. The future of wealth management must be more than balance sheets and market returns—it must help clients build a life portfolio that is rich in experience, well-being, and purpose.

What do you think? Is it time to start looking at holistic wellness as part of the portfolio?

Four Pillar Friday

Your weekly guide to thriving in every aspect of life—Physical, Mental, Spiritual, and Financial Wellness.

Four Pillar Friday

Your weekly guide to thriving in every aspect of life—Physical, Mental, Spiritual, and Financial Wellness.

Four Pillar Friday

Your weekly guide to thriving in every aspect of life—Physical, Mental, Spiritual, and Financial Wellness.