Insights Blog

Quarterly Market Commentary

April 7th, 2025 // Jack LaLiberte

Market Recap

In February, the conversation around global markets pivoted toward the uncertainty surrounding trade policy and potential tariffs. Since then, we’ve seen a divergence in domestic and international equity performance as market participants have attempted to discern the winners and losers of a more fragmented global trade network. In the meantime, bonds have played their intended role, providing ballast to portfolios during a period of equity volatility. The consumer has continued to weaken, but at a gradual pace, while the potential for re-inflation presents a threat to real returns.

Looking Ahead

Diversification is most beneficial in periods of elevated uncertainty. While valuations and concentration levels in the S&P 500 remain above historical averages, there are attractive bargains to be found globally. Although US growth is likely to continue to decelerate due to elevated political uncertainty, inflationary concerns and a weakening consumer, an imminent recession isn’t the base case for most economic forecasts. Long-term yields have declined since January, while the Fed has left rates unchanged at the short end of the curve. The Fed is unlikely to cut rates in the near term, barring meaningful inflation progress or a deterioration in economic fundamentals.

Asset Allocation

At the end of 2024, elevated domestic equity valuations and concentration set the table for market turmoil. Those factors, along with policy uncertainty, have contributed to market volatility in recent months. The best defense against volatility is to ensure that your portfolio is truly diversified. While concerning headlines have been abundant, diversified portfolios have weathered the storm relatively well thus far in 2025. Although volatility can be disconcerting, we seek to construct portfolios to match client objectives and risk tolerances, not in response to short-term market movements. Please don’t hesitate to reach out to your advisor to schedule time to discuss your financial plan, including your goals and planning assumptions. Letting planning drive the investment approach helps ensure that your portfolio remains aligned with your vision for the future.

Leading Topics

Market Volatility & Fundamentals

Coming into 2025, domestic equities were priced for perfection and the S&P 500 was concentrated in a handful of names, setting up for potential volatility. Since then, the labor market has held steady, while GDP growth has been gradually declining since the end of 2023 and consumer balance sheets have steadily weakened since the COVID-stimulus era. Ultimately, markets don’t like uncertainty. Presently, that uncertainty is the result of political turmoil around trade, regulatory and immigration policies. The policy itself is likely less impactful than the lack of clarity on what the policy will be, how it will be implemented and what retaliatory measures will result. The best defenses against policy uncertainty are allocations to fixed income and global diversification within the equity sleeve. While cash can be enticing in a volatile environment, inflation could erode nominally attractive cash yields.

Global Equity Markets

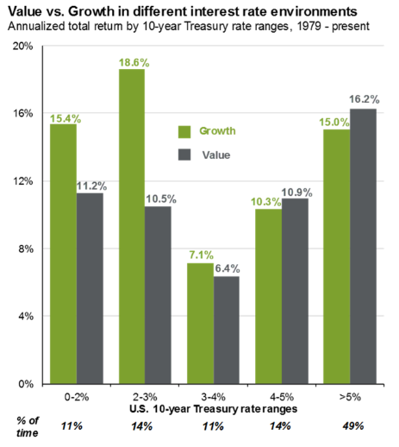

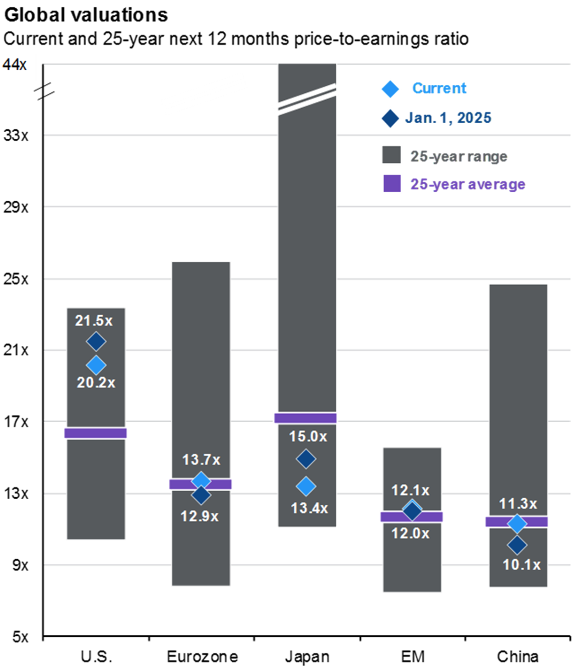

US equity valuations have improved this year but remain above historical averages. Concentration has also improved slightly but 10 stocks still represent over 30% of the S&P 500. We’ve seen positive surprises internationally, particularly in Europe and China. While valuations in Europe are attractive relative to those found domestically, that’s not the whole story. The Technology sector makes up about one third of the S&P 500. Contrarily, the largest European sector weightings are Financials, Industrials and Health Care. Higher interest rates and the prospect of potential slower growth disproportionately impact companies with high levels of earnings growth built into their valuations, such as those in the Tech sector. Historically, the performance gap between Growth and Value equities is minimal under higher interest rate environments. A potential catalyst for European equities would be a resolution to the Russia/Ukraine conflict, which has hampered flows to European equities and substantially increased energy prices for European companies. In China, markets have rallied substantially from rock-bottom valuations. There remain macro-economic and geo-political risks in China. However, as trade becomes more fragmented, China is uniquely positioned to take advantage of a burgeoning middle class that is fueling domestic consumption. Chinese real GDP grew by double the rate of US GDP in 2024. A globally allocated portfolio could provide an outsized level of diversification given increased fragmentation in global trade networks.

Federal Reserve/Fixed Income

The market and the Fed are fairly aligned on their outlook for 2025, although the range of possibilities has widened in recent weeks. Futures markets currently imply 1-3 rate cuts by the end of the year, although Fed officials have emphasized their dependence on economic data. The potential for tariffs and retaliation has increased inflationary risk, with the Fed anticipating inflation remaining above 2.5% through the end of the year. Long-term bond yields have declined since the beginning of the year, likely a product of investors forsaking volatile equities for the relative tranquility of fixed income. Although bond spreads have increased slightly, they are well below levels that would indicate corporate distress. While cash can be appealing during tumultuous market phases, a nominal 4% cash yield can erode rapidly when inflation is above 2.5%. We believe that the long-term risk-adjusted prospects for core fixed income are better than those for cash, as inflation is not expected to return to the Fed’s 2% target in the near term, making the likely trajectory for short-term rates either flat or downward.

Economic Outlook: Stable but Cautious

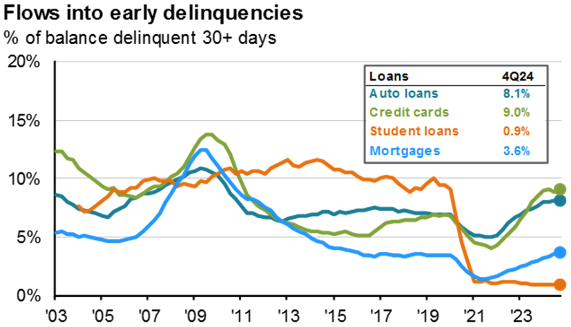

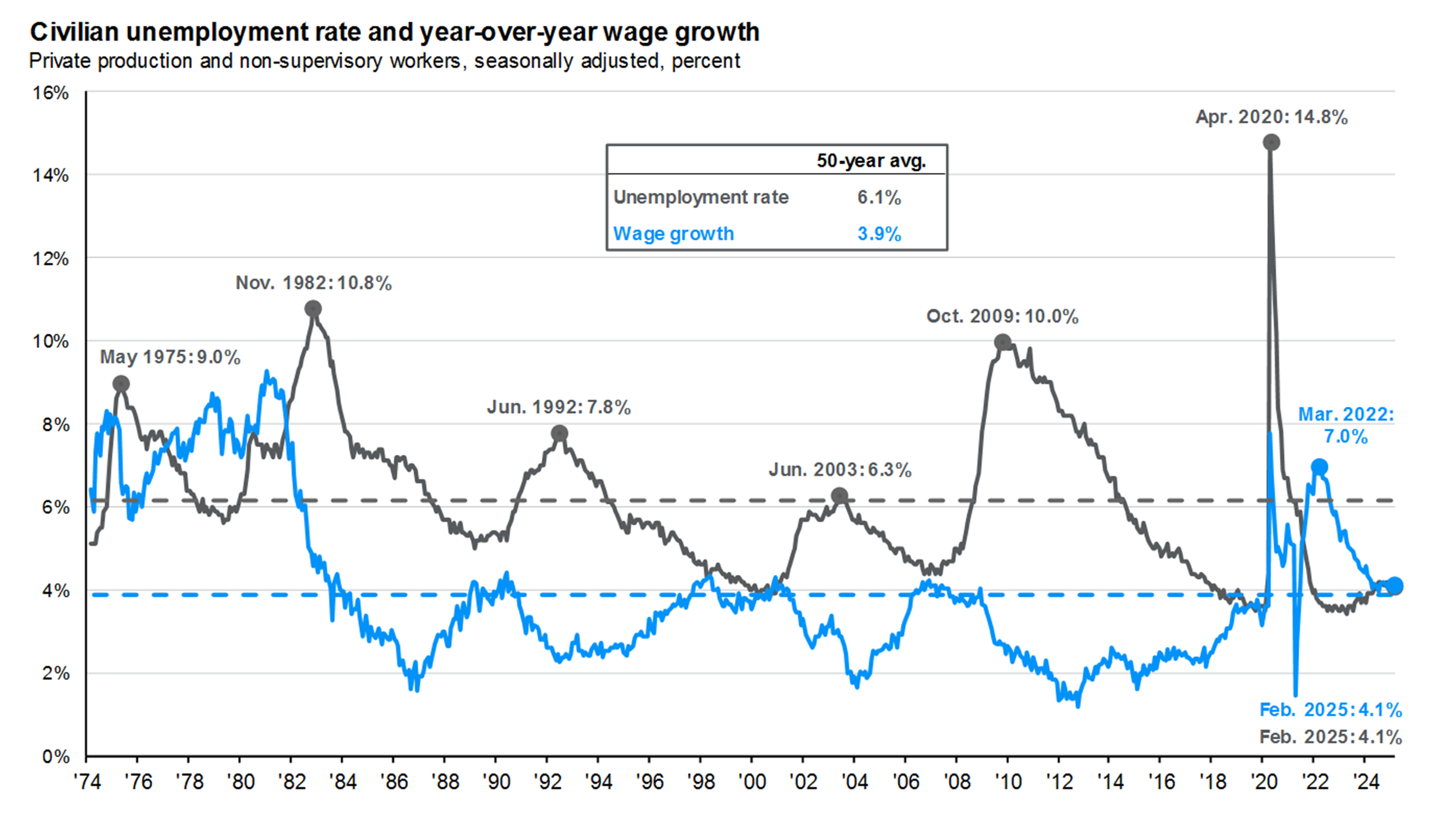

Since the COVID-stimulus era, the US consumer has gradually weakened. This is evidenced by sharply increasing consumer debt flows into early delinquency. Meanwhile, the labor market has held steady, with unemployment below the long-term average. However, there have been signs of softening, primarily in wage growth, which has plummeted from the 7% peak in 2022 to 4.1% in February. Job openings and layoffs remain near their pre-COVID levels. Overall, the labor market has weakened from the robust levels of the past few years. However, there haven’t been any signs of distress, signaling a normalization rather than a rapid deterioration.

Consumer spending represents nearly 70% of US GDP. Rising debt service costs, sharply increasing delinquencies and a consumer savings rate well below the long-term average indicate that the US consumer is strained. One driver of consumer spending, particularly at the higher end of the wealth spectrum, is the wealth effect. The wealth effect is a phenomenon in which consumers spend more when their assets appreciate. In the immediate post-COVID era, this was apparent as rising housing prices and unusually high equity returns drove additional consumer spending. As housing price appreciation has slowed and equity markets have become more volatile, that tailwind is likely to diminish. While the risk of an imminent recession remains modest, the increase in policy uncertainty and a weaker domestic consumer points to a strong possibility of slowing growth.

Inflation & Trade Policy

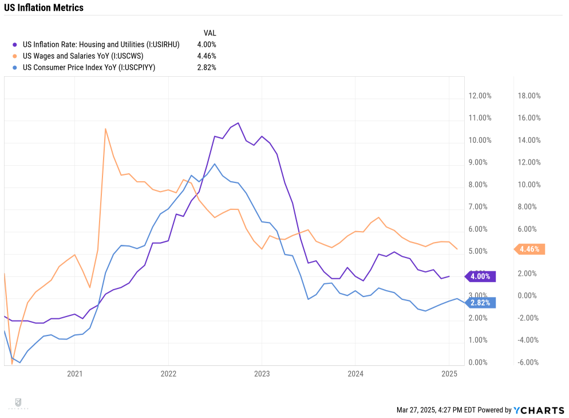

Progress on inflation was slow in 2024 and that trend has continued in the early months of 2025. Although headline inflation progress has been underwhelming, several key categories have shown improvement. Notably, housing price growth, the largest component of CPI, has slowed dramatically over the past year. At the end of 2023, housing inflation was 6.7%. That has since improved by over a third, to 4.8% YoY. Wage growth, a key leading indicator of inflation, has also slowed, from 6% at the end of 2023 to 4.5% in January. If it weren’t for the uncertainty surrounding trade policy, the outlook for inflation would seem to be improving, albeit gradually.

The wildcard in attempting to discern the trajectory of inflation is the outlook for trade policy. It’s tremendously difficult to determine what the exact impact of tariffs will be on inflation. This is partially due to the uncertainty over which tariffs will be implemented, how long they will be in effect for and what retaliation will occur. While determining the precise impact is an exercise in speculation, most forecasters expect tariffs to increase CPI by about half of a percentage point. Since COVID, companies have become more flexible in their supply chains and ability to adapt to pricing changes. That represents a significant difference in the current environment as opposed to the first Trump administration. In 2018 and 2019, the CPI fluctuated between 1.5% and 2.9%, making it more difficult for companies to pass along costs. Since COVID, consumers have become more accustomed to price increases, raising the risk of a re-acceleration of inflation if the tariff cycle continues.

Federal Reserve Update & Fixed Income Outlook

In their March meeting, the Fed held rates steady and slowed the pace of quantitative tightening. The next FOMC meeting won’t occur until May and futures markets don’t anticipate a rate cut until at least June. The market is pricing in approximately 2-3 cuts this year, with almost no chance of a rate hike. While the Fed seems ready to step in if needed, more evidence of weakness in the labor market is likely required to force additional rate cuts. Historically, a real Fed Funds rate around 2% is the norm. The current real Fed Funds rate is around 1.5%, making it difficult to call the current Fed positioning restrictive. The combination of a stable labor market, unsustainable Federal spending and the possibility of continued trade policy uncertainty sets the table for potential stubbornness in inflation, making the Fed less inclined to cut rates.

Fixed income has played its intended role in portfolios thus far in 2025. Higher long-term yields coming into the year positioned fixed income well. Equity volatility has also been a tailwind, as some investors have sought out the relative safety of fixed income. While that flight to safety has been beneficial for bond owners, it’s also driven down longer-term rates slightly, reducing term premium. Given the flatness in the yield curve, we don’t recommend aggressively extending duration but do believe that core fixed income presents a better risk-adjusted opportunity than cash. Long-term rates are unlikely to compress substantially, given continued elevated debt issuance by the Federal Government. While the outlook for fixed income is slightly less appealing than it was at the end of 2024, yields are still well above average relative to the past decade. Meanwhile, the outlook for cash yields is poor. The two most likely paths for the US economy are slower growth with elevated inflation risk or a recession. In the first scenario, the Fed is likely to keep short-term rates the same or gradually reduce them. In a recessionary scenario, the Fed is likely to reduce short-term rates rapidly. Under either scenario, we’d expect cash equivalents to underperform relative to fixed income.

Domestic Equities: Valuation & Concentration

After a banner year for domestic equities in 2024, 2025 is off to a bumpier start. The volatility in the first quarter was largely a product of the concentration of the S&P 500 in a handful of names, along with elevated valuations. In 2024, the seven largest stocks in the S&P 500 accounted for over half of the Index’s gains. Since late 2023, domestic earnings growth has broadened out, a potential stabilizing factor moving forward. Although some large names have pulled back significantly in 2025, the valuation of the S&P 500 remains far from cheap. The trailing 12-month PE ratio has declined marginally from 29x to nearer to 20x, a reasonable pull-back but still at or slightly above the historical average. While breadth has improved slightly, the S&P 500 remains concentrated, with 10 companies making up over 30% of the Index.

While Growth equities, primarily the Magnificent 7, have garnered much of the attention and an outsized proportion of returns in recent years, there’s no assurance that will continue. Historically, the returns between Value and Growth equities have been very similar when interest rates are elevated (10-year treasury over 4%). Additionally, some value-oriented sectors, including Financials and Energy, are likely more insulated from tariff risk than some of their cyclical counterparts. At the end of the day, we don’t believe that investors should avoid the largest US names entirely. However, if 2025 has taught us anything thus far, its that a balanced, diversified approach can weather volatility far better than concentration.

Where’s All The Housing Supply?

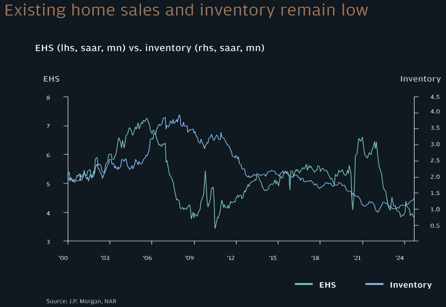

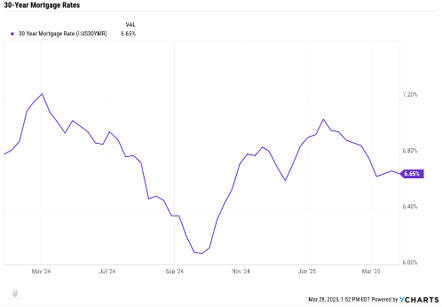

Over the past year, mortgage rates have trended downward. After their recent peak above 7% in January, average rates for 30-year mortgages have declined to around 6.65%. While the downtrend has been beneficial for homebuyers, the gap between rates on new loans and those for existing mortgages remains wide. That trend is unlikely to change in the near term, as few forecasters anticipate mortgage rates dipping below 6% in 2025.

Inventory and sales levels remain well below historic norms, although inventories improved throughout 2024. Housing starts have also improved. 2024 also saw record multi-family unit delivery, easing some of the supply-demand imbalance. Potential tariffs on materials are likely to create another headwind for housing starts, as Canada accounts for nearly half of US lumber imports.

While housing starts and sales are likely to remain muted, price appreciation is expected to continue at a modest pace, largely driven by the lock-in effect brought about by the path of interest rates and low inventories. Low vacancy rates imply plenty of housing demand, but the outlook for supply is likely to remain constrained unless long-term rates drop meaningfully, compressing the trade-off between new and existing mortgage loans. Given the outlook for government borrowing, that kind of movement in long-term rates seems unlikely in the near term.

International Equities: The Benefits of Diversification

After years of living in the shadow of their US counterparts, International equities performed well in the first quarter. While there are myriad risks facing international equities, there are also plenty of obstacles facing domestic companies, namely policy uncertainty, slower growth and elevated inflation risk. The thesis for investing internationally is based on four pillars: strong fundamentals, attractive valuations, a weaker Dollar and a greater level of diversification.

Both Europe and China have shown some positive signs in terms of fundamentals. GDP in China is expected to grow at about 4.5% in 2025, much faster than the expectation for the US. Emerging Market countries are expected to make up about 50% of global GDP within the next decade. While slower growth in the Eurozone is concerning, European inflation has been on a much more convincing downward trajectory than its US counterpart. Additionally, European valuations are reasonable on a relative and historical basis, while the value tilt of the European sector makeup could be beneficial in an era of higher rates and slower growth. The US Dollar Index recently hit highs not seen since 2022, before pulling back. If the Fed restarts the rate cutting regime later this year, the Dollar is likely to weaken further. A potential catalyst for European equities would be a resolution to the Russia/Ukraine conflict, which has hampered flows to European equities and substantially increased energy prices for European companies. In China, there remain macro-economic and political risks. However, as trade becomes more fragmented, China is uniquely positioned to take advantage of a burgeoning middle class that is fueling domestic consumption.

In an environment where the S&P 500 is highly concentrated in both sectors and individual names, international equities offer valuable diversification. The only certainty from a trade policy perspective is uncertainty. The past quarter has shown the peril of a portfolio concentrated in US equities. We aren’t recommending a drastic international overweight. However, we believe that a meaningful international equity allocation offers diversification benefits in addition to exposure to attractive valuations and growth trends.

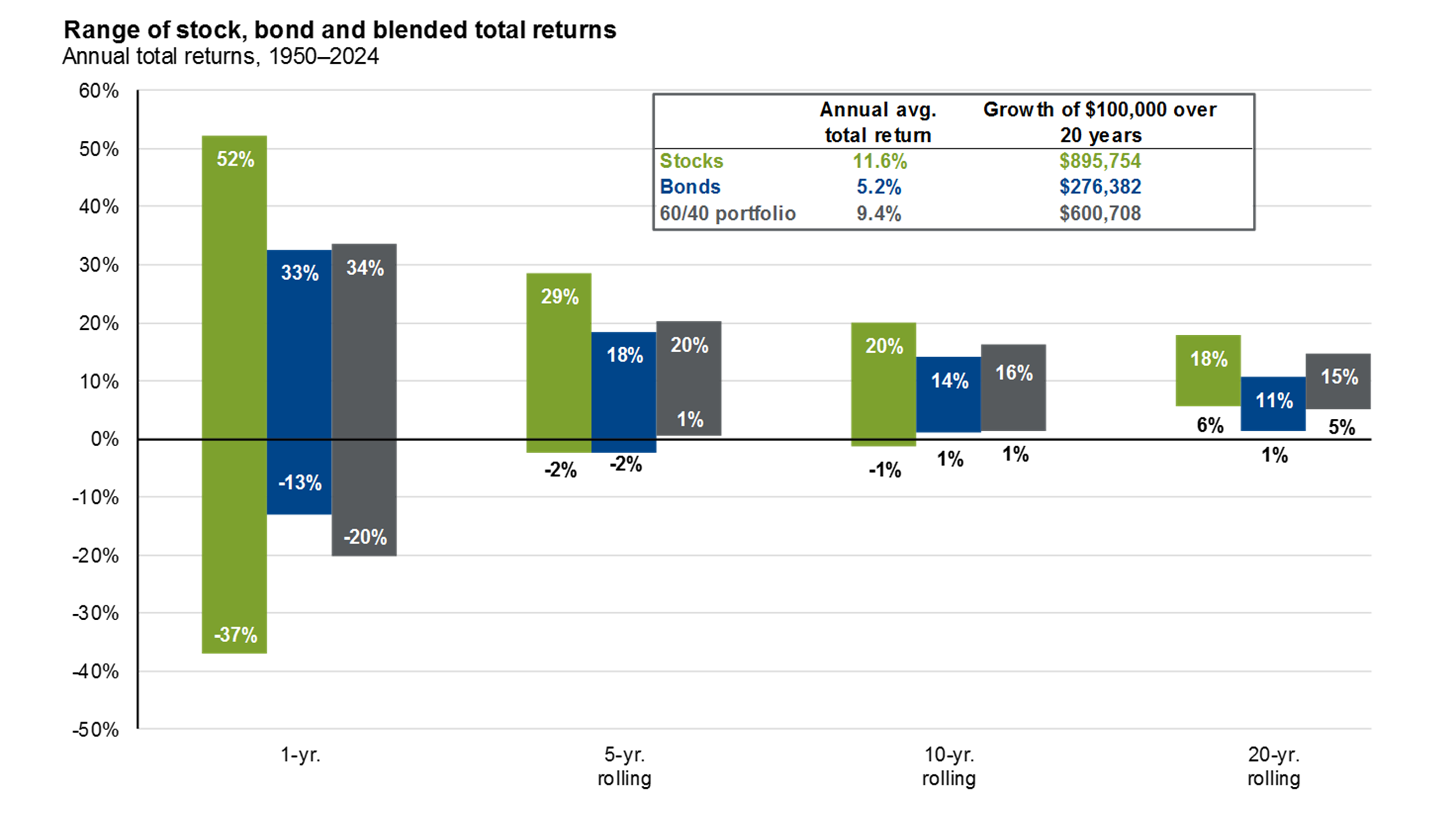

Behavioral Finance: Headline Risk & Staying Invested

Over the past few months, the deluge of concerning headlines has been constant. While it’s easy to believe that market turmoil is unusual, given the low volatility environment of 2023 and 2024, volatility is the historic norm. Since 1974, the S&P 500 has experienced 27 corrections. A correction is defined as a peak-to-trough decline of 10% or more. The average correction sees the market decline by 14.1%. Notably, the average recovery only takes four months. Ultimately, market movements are all a matter of perspective. Looking back over the past 20-30 years, there have been many periods of market and political uncertainty. Think back to the period after 9/11, the Global Financial Crisis or the COVID Pandemic. Each of these periods were fraught with uncertainty and it would’ve been easy to sit on the sidelines to wait for “the right time”. Unfortunately, in investing as in life, there is rarely a clear “right time”. While short-term market outcomes are unpredictable, over longer time horizons markets are remarkably consistent, as evidenced by the narrowing of return outcomes over longer horizons.

Hindsight bias is the tendency for past events to appear predictable after the fact. For example, some may insist that after a sporting event, the outcome was preordained. In that respect, it seems easy to see that staying invested during COVID or the 2008 crisis were the obvious optimal choices. In the moment, it’s never that clear. However, by taking a long-term approach and not allowing short-term market movements to dictate our reactions, we can all make better-informed decisions. There are certainly risks ahead, as is always the case. However, we’ve learned that the appropriate method for dealing with risk is to build an asset allocation that aligns with your plan and your risk tolerance, rather than trying to time markets. While the outlook for market returns is likely to be muted in the next decade relative to the recent past, history has shown that there are few better alternatives to remaining invested over the long term.

What’s It All Mean

Economic Outlook

US consumer health has eroded steadily as the post-COVID stimulus has worn off, evidenced by declining savings rates and rising consumer debt delinquencies. The labor market appears stable, although wage growth has slowed. While the risk of an imminent recession remains modest, the increase in policy uncertainty and a weaker domestic consumer points to a strong possibility of slowing growth.

Federal Reserve & Fixed Income

In their March meeting, the Fed held rates steady. The market is pricing in approximately 2-3 cuts this year. Given the flatness in the yield curve, we recommend somewhat cautious duration positioning. Long-term rates are unlikely to compress substantially, given continued elevated issuance of debt by the Federal Government. However, we believe that core fixed income represents a more attractive risk-adjusted opportunity than cash, as the most likely trajectory for cash yields is either flat or downward.

Inflation & Trade Policy

The wildcard in attempting to discern the trajectory of inflation is the outlook for trade policy. While several key components of inflation have improved over the past year, trade wars and expansionary fiscal policy pose an upside risk to inflation. Since COVID, consumers have become more accustomed to price increases, raising the risk of re-accelerating inflation if the tariff cycle continues.

Equity Outlook

The market volatility in the first quarter was largely a product of the concentration of the S&P 500 in a handful of names, along with elevated valuations. While growth equities, primarily the Magnificent 7, have captured much of the attention and an outsized share of returns in recent years, there’s no assurance that will continue. We believe that a meaningful international equity allocation offers diversification benefits in addition to exposure to attractive valuations and growth trends.

Relevant Disclosures: This information was prepared by FSM Wealth Advisors, LLC d/b/a Journey Wealth Management, LLC (“Journey”), a federally registered investment adviser under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply a certain level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. Journey’s Form ADV Part 2A and Part 2B can be obtained by written request directly to: 22901 Millcreek Blvd., Suite 225, Cleveland OH 44122.

The information herein was obtained from various sources. Journey does not guarantee the accuracy or completeness of information provided by third parties. The information provided herein is provided as of the date indicated and believed to be reliable. Journey assumes no obligation to update this information, or to advise on further developments relating to it.

Investing involves the risk of loss and investors should be prepared to bear potential losses. Past performance is not indicative of future results. Neither the information nor any opinion expressed herein should be construed as solicitation to buy or sell a security or as personalized investment, tax, or legal advice. For advice specific to your situation, please consult an appropriately qualified professional investment, tax or legal adviser.

Four Pillar Friday

Your weekly guide to thriving in every aspect of life—Physical, Mental, Spiritual, and Financial Wellness.

Four Pillar Friday

Your weekly guide to thriving in every aspect of life—Physical, Mental, Spiritual, and Financial Wellness.

Four Pillar Friday

Your weekly guide to thriving in every aspect of life—Physical, Mental, Spiritual, and Financial Wellness.