Insights Blog

Mid-Quarter Market Commentary

May 23rd, 2025 // Jack LaLiberte

Market Recap

Beginning in April, both fixed income and equity markets saw a return of volatility, to a degree we haven’t experienced since the early days of COVID. The implementation and threat of additional tariffs increased the risk premium in equities and placed pressure on bond yields. While the rapidity and magnitude of the decline in US equities was jarring, the lofty valuations and high degree of concentration present in the S&P 500 at the beginning of 2025 left US equities in a vulnerable place. While domestic valuations remain lofty, the employment picture is strong. International equities continue to offer a compelling opportunity due to reasonable valuations, greater diversification and intriguing growth tailwinds. The Fed appears hesitant to reduce short-term rates, barring a deterioration in economic fundamentals. Future inflation expectations, along with an ample supply of government debt, are likely to maintain a floor on longer-term bond yields. While predicting the precise path and impact of trade policy is impossible, volatility is likely to persist as markets adjust to elevated levels of uncertainty.

Looking Ahead

While volatility is likely to persist as shifting trade dynamics and a re-calibration of lofty valuations are digested by market participants, fundamentals in the US and most of the rest of the world remain strong. Given the level of concentration within US equity markets, we believe that international, value and small-cap equities provide a critical element of diversification. Fixed income offers a meaningful yield improvement for cash-heavy investors and is playing its intended role as a volatility mitigator during uncertain times. We advocate building portfolios to achieve your long-term goals as opposed to trying to react to the latest headlines. We can’t anticipate the next trade developments or geopolitical shock, but we do take the time to review your personal financial plan and ensure that your investments align with your goals. Please don’t hesitate to reach out to your advisor to schedule time to discuss your financial plan, including your goals and planning assumptions.

Leading Topics

Tariffs & Markets

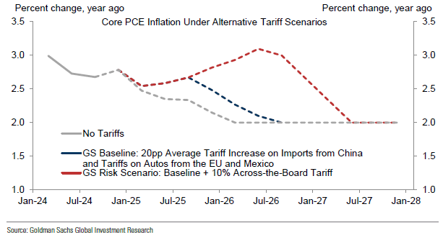

Keeping track of which tariffs have been implemented and which have been delayed has been challenging. As of early May, 10% universal tariffs have been applied, along with higher rates on certain Mexican, Canadian and Chinese goods. The impact remains difficult to assess, largely due to uncertainty over how long tariffs will remain in effect. EPS growth estimates have declined slightly from prior quarters, although the full impact will likely take some time to be absorbed. While trade uncertainty is disconcerting, long-term growth and demographic trends are likely to have a far greater influence on future returns. Companies have shown resilience by adjusting supply chains and passing costs onto consumers. The consumer has become more accustomed to price hikes in the post-COVID era, allowing companies to pass through much of the added cost. The combination of tariffs and a limited political appetite for meaningful deficit reduction is likely to maintain elevated inflation and higher long-term yields.

Federal Reserve & Interest Rates

The Fed has kept rates steady since the end of 2024, citing stubborn inflation and a healthy labor market. Futures markets are currently pricing in two to three rate cuts for 2025, though there’s substantial uncertainty around the timing of cuts. Long-term rates are likely to remain elevated regardless of the Fed’s positioning, potentially crowding out corporate investment and consumer spending.

Fixed Income

Given the possibility of persistent inflation and substantial government debt issuance, we expect long-term rates to remain elevated. Long-term rates are driven by a variety of factors, but future inflation expectations are a significant input. There is a meaningful yield advantage in core fixed income relative to cash. Although cash can be a tempting haven in periods of uncertainty, it has historically underperformed fixed income in most market environments. While bond investors still bear the scars of 2022, the yield environment is very different today. Investors are receiving more substantial compensation for owning fixed income relative to cash. Those elevated rates insulate fixed income investors from volatility in interest rates, while cash yields are likely to remain the same or decline.

Equities: Valuation & Concentration

While it’s easy to focus on the immediate impact of tariffs on markets, foreshocks of volatility in the tech sector began in January. Elevated valuations and concentration in US equities made them vulnerable to negative surprises. The S&P 500’s valuation remains well above the long-term average, particularly when higher rates are factored into the discounting of future earnings. While the bulk of returns have been generated by a narrow segment of the equity universe over the past decade, returns tend to be more broad-based when interest rates are elevated. The valuation level and highly concentrated nature of the S&P 500 could set up for continued volatility if fundamentals deteriorate. We’d recommend reviewing your equity exposure and diversifying to less richly valued segments, including value, small-cap and international equities.

Economic Fundamentals: A Mixed Picture

US consumer spending accounts for about two thirds of domestic GDP. In the immediate aftermath of COVID, the consumer was economically insulated, aided by low interest rates and government stimulus. The state of the consumer has shifted in recent years. Lower income households have borne the brunt of the reduction in financial stability. Households with lower levels of wealth haven’t participated to the same degree in the appreciation of asset values, while interest rates on consumer debt have jumped. It’s now estimated that the top 10% of households account for about 50% of US consumer spending. As net savers, those wealthier households are less vulnerable to higher rates. However, households with more robust balance sheets may be susceptible to the wealth effect. The wealth effect is a phenomenon where consumers spend more when their assets appreciate. If equity and real estate price growth slows from the torrid pace of the past few years, wealthier consumers may become more hesitant to spend.

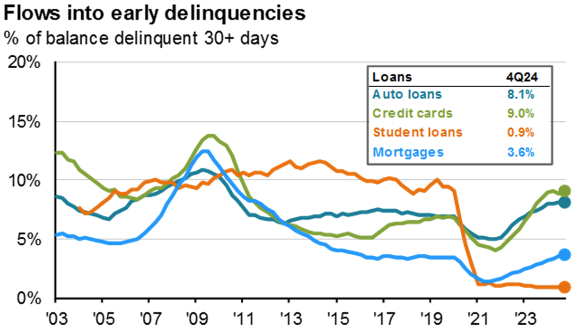

In addition to a slowdown in spending, consumer debt delinquencies have jumped to levels not seen since the financial crisis. The cumulative strain of years of elevated inflation has forced many consumers to lean on high interest auto loans and credit cards to close funding gaps. Delinquencies on these loans have jumped substantially over the past three years. While the domestic consumer appears stretched, the labor market has remained resilient. Even with the DOGE cuts to government employment and heightened uncertainty around trade, new weekly unemployment claims have remained remarkably stable. Continued jobless claims have remained range-bound since late last summer, indicating stability in the labor market. A weaker consumer and a higher degree of trade uncertainty, coupled with elevated borrowing rates, is likely to limit growth. However, a recession remains unlikely as long as strength in the labor market persists.

Tariff Update

As of mid-May, the US has imposed a 10% tariff on nearly all imports, with some exceptions. There are more substantial tariffs in effect on Canadian, Mexican and Chinese goods, as well as additional tariffs that have been postponed until July. First quarter GDP data was distorted by companies attempting to pull forward imports and build up inventories prior to tariff implementation. Headline GDP contracted by 0.3% in the first quarter, raising concerns of a recession, generally defined as two consecutive quarters of negative GDP growth. Untangling the impact of trade uncertainty from underlying economic strength provides a clearer picture. In the first quarter, net imports reduced GDP by 4.8% as importers sought to stockpile goods. Inventory growth boosted Q1 GDP by 2.3%. Taken together, the approximate net impact of tariff adjustments in the first quarter was a 2.5% reduction in GDP. Once that is backed out of the headline figure, underlying GDP growth would be 2.2%. While that represents a deceleration from recent quarters, it’s far from a recessionary level.

The impact of tariffs on equity markets is difficult to forecast, given the ever-changing proposals on the table. However, industrials and some consumer cyclical companies are particularly susceptible to volatile trade dynamics. Financials are likely one of the sectors that is more insulated from tariff risk. US equity markets have swung wildly in recent weeks due to the lack of clarity on tariff magnitude and timing. On the fixed income front, higher inflation expectations, which are partially driven by tariffs, are likely to keep long-term yields elevated. A steeper yield curve is a hindrance to long-term borrowers, such as homebuyers, but could present an opportunity for fixed income investors.

Equity Markets: Valuation & Concentration

After a reversal in early April, the largest components of the S&P 500 have bounced back, bringing elevated concentration and valuation levels back to the forefront. While these large companies have driven a substantial portion of equity returns over the past five years, their valuations are also some of the most strained. As of the end of April, the PE ratio of the top 10 stocks in the S&P 500 was about 26x, while those of the remainder of the Index were closer to 18x. Although valuations can stray from historical averages for extended periods, the combination of elevated valuations and a high degree of concentration creates a ripe environment for volatility. While it’s easy to blame the market downswing on tariffs, US large cap equities were priced for perfection coming into 2025. A minor reduction in AI investment or a weakening in consumer health could have a substantial impact on these large tech names.

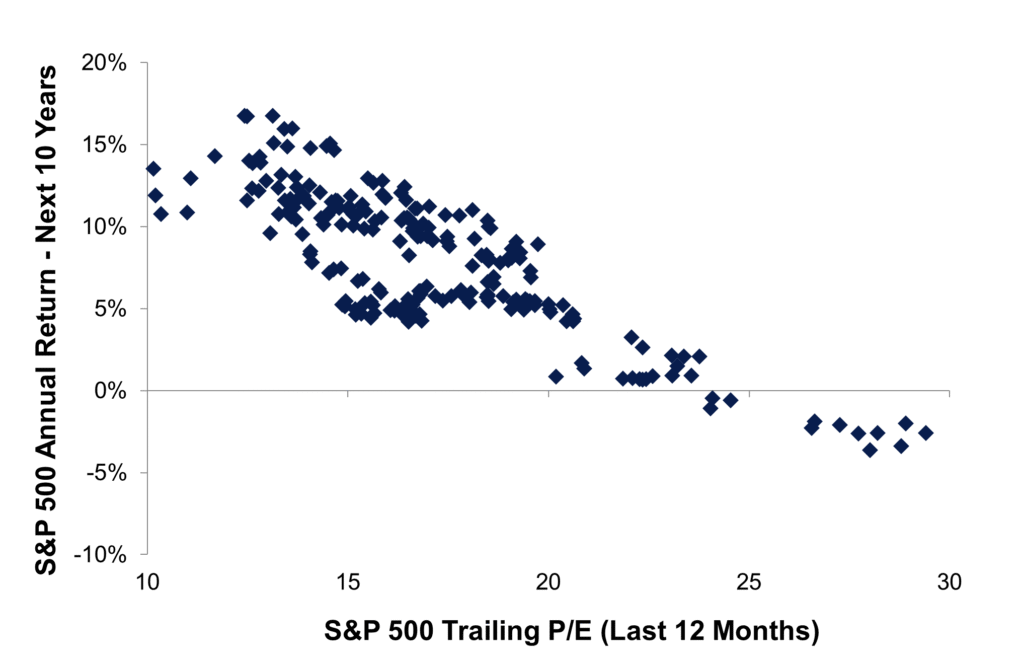

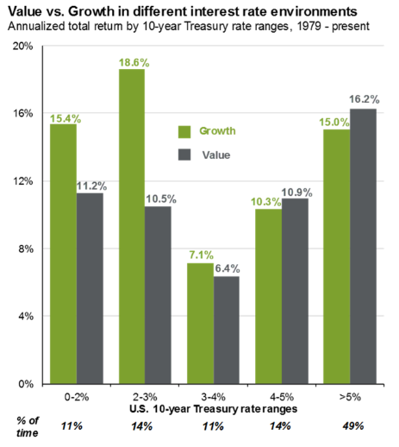

While growth equities have outperformed their value counterparts over the past decade, growth equities haven’t historically outperformed in higher interest rate environments where the 10-year treasury was above 4%. We don’t advocate avoiding US large cap equities in their entirety. However, we firmly believe in the prudence of diversification as well as the fact that valuations matter. The S&P 500 has not experienced positive 10-year subsequent returns when the starting valuations are as elevated as they are today. In addition to lofty valuations, ten companies now account for nearly 36% of the S&P 500’s market cap. There are several areas, including small cap domestic equities as well as international equities, where valuations are nearer to their historical averages and there is less concentration risk.

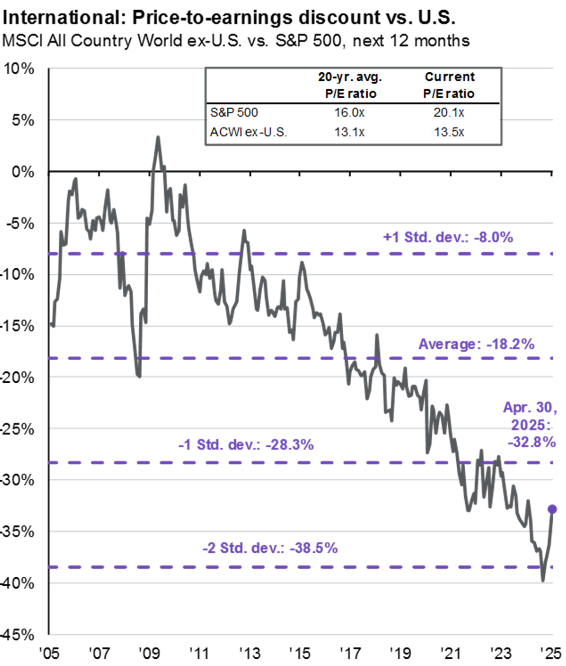

The Power of Diversification

Over the past decade, large cap US growth equities have dramatically outperformed the rest of the equity universe, leading some investors to question the wisdom of diversifying outside of this narrow neighborhood. 2025 has been a case study in the pitfalls of concentration. Coming into 2025, the S&P 500 was trading around 28x trailing earnings, while ex-US equities were trading at closer to 16x earnings. While it’s extremely difficult to predict when or why valuations may contract, valuations give us some insight into the fragility of markets. High valuations don’t necessarily mean returns will be poor in the future, but they do make markets more vulnerable to negative surprises.

That vulnerability was apparent over the past few months. While it’s easy to blame the market pull-back solely on trade uncertainty, that’s an oversimplification. At the end of 2024, many US equity valuations were riding high on AI hype as well as hopes for deregulation and tax cuts from the new administration. Cracks began to form in the AI thesis in January. While AI is a powerful tool and is likely to play a substantial role in shaping the future of work, uncertainty over the magnitude of investment in the space and optimistic valuations led to a drawdown in the sector in January. The risk-off sentiment driven by trade fears generated substantial additional volatility in April.

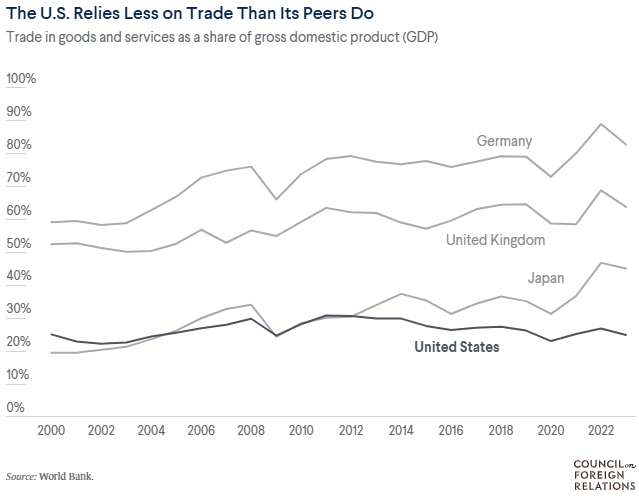

While many US equities recovered rapidly as trade fears have eased, the benefits of diversification remain apparent. Through April, the S&P 500 had declined 4.9%, whereas the ACWI ex-US Index had appreciated by 9.3% YTD or 2.8% in local currency. The gap in performance is notable. While it would be disingenuous to suggest that we predicted international outperformance, we’ve often discussed the valuation gap between US and international equities as well as the extent of domestic concentration. We can’t predict the future, but in an era of higher interest rates and shifting supply chains, we consider allocating globally to be a prudent approach rather than concentrating in a single region.

The Fed & Fixed Income

Thus far in 2025, the Fed has held the Fed Funds rate steady at 4.25-4.5%, following 100 bps of cuts in 2024. The magnitude of expected cuts this year has gradually diminished over the past few months. Futures markets indicate that the Fed is likely to cut by 50 bps this year, with the first cut expected in September. Given the distortions in economic data due to trade disruption and the stability in the labor market, the Fed is likely to wait for compelling evidence of falling inflation before acting. Shelter inflation, the largest component of CPI, has continued its steady downward trend. The great unknown is to what extent the trade war will translate into additional inflationary pressure. The Fed is incentivized to take a wait and see approach as opposed to being overly accommodative and subsequently having to re-tighten policy.

Bond markets experienced some volatility in April but have provided a steadying influence relative to equities. Fixed income investors can expect reasonable yields to compensate for taking interest rate risk. Notably, investors no longer need to accept a yield discount to shift from cash equivalents to core fixed income. While expectations for Fed cuts this year are low, the trend for short-term yields is likely to be flat to slightly downward. A few years ago, bonds provided little yield and served primarily to mute volatility, whereas they now offer meaningful income as well as an avenue for capital appreciation.

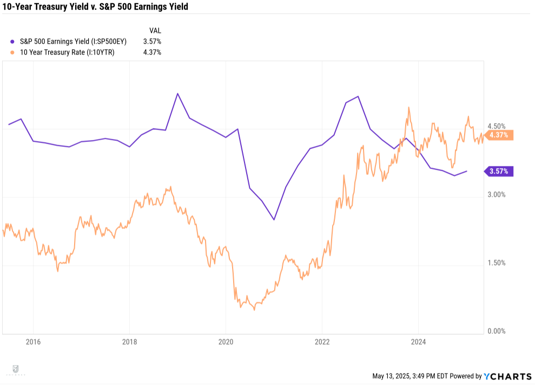

As asset allocators, we’re constantly evaluating the relative attractiveness of various asset classes. On the equities front, valuations are a decent predictor of long-term returns, analogous to yields in fixed income. In late 2023, the yield on the 10-year treasury surpassed the S&P 500 earnings yield (inverse of the PE ratio), and the spread has since widened, making bonds attractive relative to equities. There’s a substantial amount of noise around trade, the Fed and a myriad of other factors that promote yield curve volatility. However, the yields available in fixed income remain attractive, especially compared to cash equivalents and the elevated valuations on offer in equities.

Municipal Bond Spotlight

Municipal bonds represent a unique corner of the fixed income universe. While movements in interest rates are a key driver of performance, the municipal bond market has some idiosyncrasies. The tax-exempt status that many municipal bonds enjoy means that the universe of buyers is narrower than it is for taxable bonds. Additionally, the smaller size of the municipal market makes it more sensitive to changes in issuance.

This year, the performance gap between municipal bonds and their taxable counterparts has been notably wide. As of mid-May, the return gap between municipals and taxable bonds is about 3% YTD. Why have municipal bonds performed poorly? It’s not due to credit concerns, as spreads remain tight and municipalities are well-funded. It’s likely due to two factors: issuance and the retail nature of municipal markets.

Municipal issuance through April was up about 12% relative to 2024. Notably, the summer issuance calendar indicates a reversion in this trend. Net issuance for the next quarter is expected to be near zero, likely providing a tailwind for existing bonds. In April, municipals didn’t see the same flight to quality as taxable bonds, placing a damper on relative performance. Furthermore, municipal bonds typically see outflows in April as investors raise cash for tax payments. Although the recent technical background for municipals has been unfavorable, low summer issuance is likely to provide a more supportive environment. Municipal yields are near the highest we’ve seen over the past decade. Tax-equivalent yields, assuming the highest Federal tax bracket, sit near 7% for the Bloomberg Municipal Index, offering attractive yields without the need to stretch on credit quality.

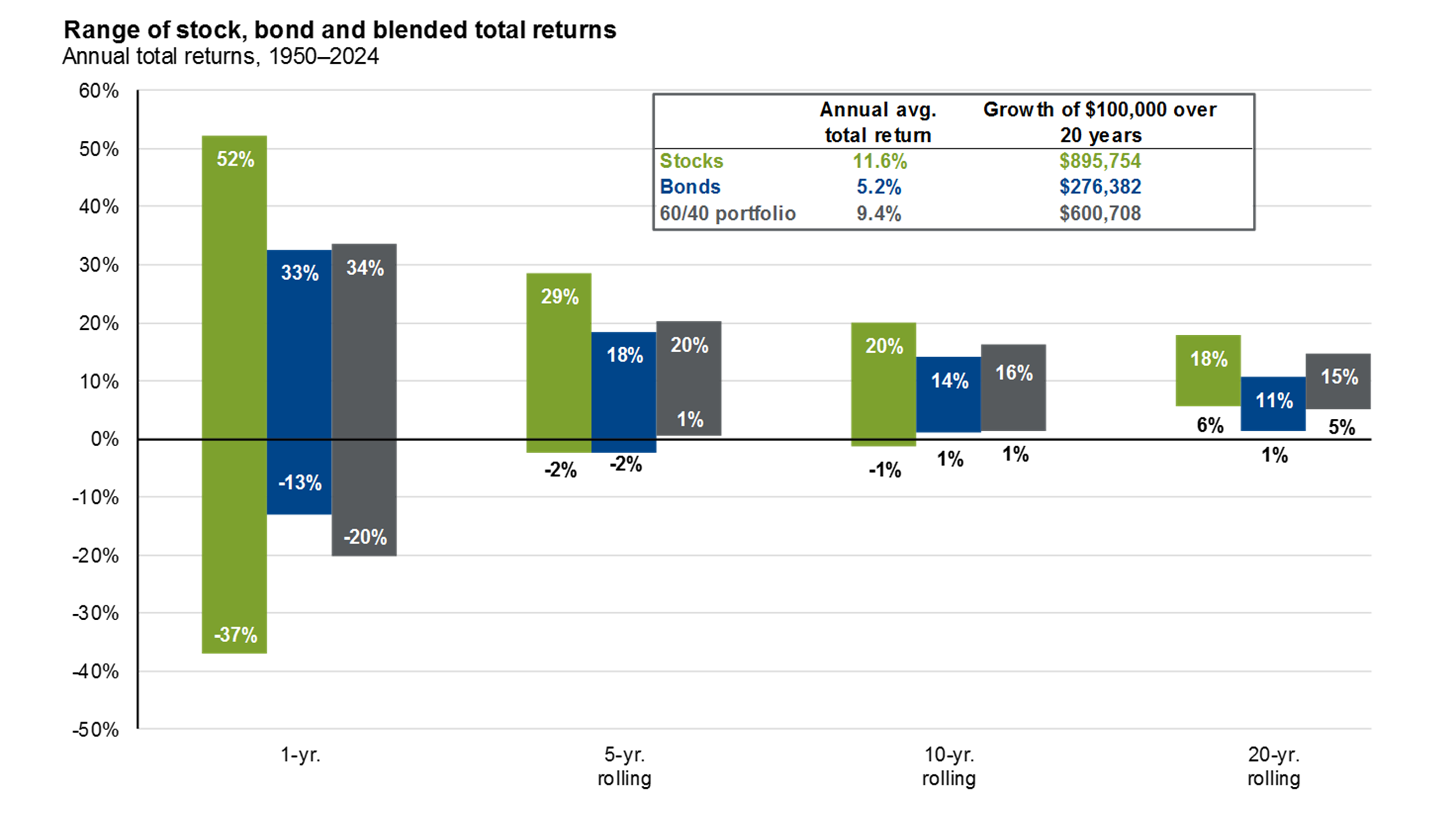

Focusing On The Long Game

April was a stark reminder of the potential volatility in markets. It was particularly jarring after the lack of turmoil in recent years. Using the VIX, a measure of equity market volatility, as a guidepost, 2024 was the least volatile year for the S&P 500 since at least 2020. The market movements in early April were a great reminder of how unpredictable short-term equity returns can be. Although the S&P 500 has delivered positive returns in 34 of the past 45 years, the average intra-year decline was 14.1%. These recent developments are an example of why we advocate for a long-term investment strategy. Unlike many other facets of life, market returns become more predictable over longer time horizons. For example, one-year stock market returns since 1950 have ranged anywhere from an increase of 52% to a decline of 37%, a spread of nearly 90%. Over a 20-year rolling period, that range is much narrower, between a 6% and 18% annual return. When blending an allocation of multiple asset classes, that range becomes even narrower.

At the end of the day, no one knows what the administration will elect to do in the coming months and for long-term market returns, it likely doesn’t matter. We believe that remaining fully invested in all political environments, in line with your personal financial plan, is critical to compounding returns over long horizons. While it may be tempting to sit on cash during periods of uncertainty, the return drag of cash relative to other asset classes is meaningful over time. This is particularly true during periods where inflation remains elevated, as could be the case if the cycle of tariffs and retaliation continues. As always, if you have market concerns, please reach out to your advisor to discuss those concerns and the potential impact on your personal financial plan.

What’s It All Mean

Equity Valuations

US Equity markets remain highly concentrated in a handful of names. Valuations, particularly for the largest US companies, are above historic norms. If your portfolio looks like the S&P 500, you may be more exposed to volatility than a more diversified allocation that includes international and small-cap equities. These segments also sport valuations that are nearer to their historical averages than those of US large cap equities.

Federal Reserve & Fixed Income

The market now anticipates one to three Fed rate cuts this year, largely due to uncertainty around inflation as well as a robust labor market. While inflation has modestly improved, upside risk remains as the impact of tariffs is absorbed. Long-term yields are driven by dynamics in the Treasury market as well as inflation expectations. Both of those trends point towards sustained higher yields. Long-term rates sit at attractive levels, both relative to cash yields and equity valuations.

Tariffs & Markets

The impact of tariffs on equity markets is difficult to forecast, given the ever-changing proposals on the table. However, industrials and some consumer cyclical names are particularly susceptible to volatile trade dynamics. Financials are likely one of the sectors that is most insulated from tariff risk. Even if tariffs are removed in their entirety, the increase in uncertainty due to trade policy is likely to modestly dampen business activity and investment.

Diversification & Time Horizons

Although recent periods of low volatility may have lulled investors into a false sense of security, April served as a jarring wake-up call. Volatility is a normal part of the investment experience. That’s why we advocate for long time horizons and diversified portfolios that align with your personal goals and risk tolerance. We believe that remaining fully invested, in line with your personal financial plan, is critical to compounding returns over long time horizons.

Relevant Disclosures: This information was prepared by FSM Wealth Advisors, LLC d/b/a Journey Wealth Management, LLC (“Journey”), a federally registered investment adviser under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply a certain level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. Journey’s Form ADV Part 2A and Part 2B can be obtained by written request directly to: 22901 Millcreek Blvd., Suite 225, Cleveland OH 44122.

The information herein was obtained from various sources. Journey does not guarantee the accuracy or completeness of information provided by third parties. The information provided herein is provided as of the date indicated and believed to be reliable. Journey assumes no obligation to update this information, or to advise on further developments relating to it.

Investing involves the risk of loss and investors should be prepared to bear potential losses. Past performance is not indicative of future results. Neither the information nor any opinion expressed herein should be construed as solicitation to buy or sell a security or as personalized investment, tax, or legal advice. For advice specific to your situation, please consult an appropriately qualified professional investment, tax or legal adviser.

Four Pillar Friday

Your weekly guide to thriving in every aspect of life—Physical, Mental, Spiritual, and Financial Wellness.

Four Pillar Friday

Your weekly guide to thriving in every aspect of life—Physical, Mental, Spiritual, and Financial Wellness.

Four Pillar Friday

Your weekly guide to thriving in every aspect of life—Physical, Mental, Spiritual, and Financial Wellness.