Insights Blog

Volatility is Normal — So Is Growth: What 45 Years of Market History Can Teach Investors

April 24th, 2025 // Michael Baker

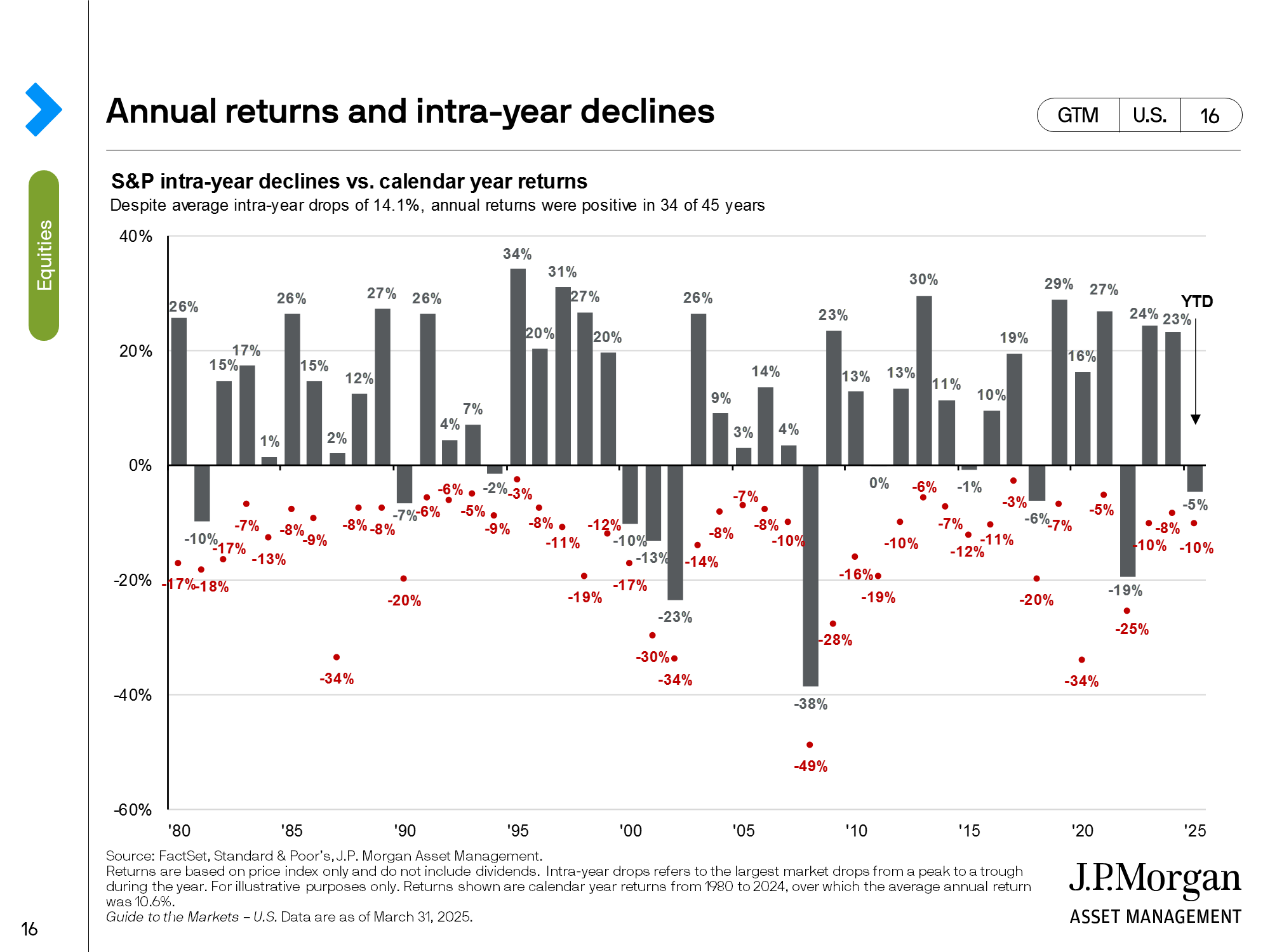

Market volatility can be deeply unsettling. Sharp declines, unsettling headlines, and sudden drops in portfolio values often leave investors questioning whether it’s time to step aside and wait for calmer markets. But history tells a different story—one that consistently rewards discipline, patience, and perspective over reaction. One of our favorite visuals from J.P. Morgan Asset Management’s Guide to the Markets illustrates this truth clearly. From 1980 through the first quarter of 2025, the S&P 500 experienced an average intra-year decline of 14.1%. Despite these frequent pullbacks, the market ended the year in positive territory 34 out of 45 times. Volatility is not an exception—it’s a core feature of the market. But so is resilience.

Understanding the Data

-

The red dot shows the worst intra-year drop — the lowest point the market hit.

-

The gray bar represents the final calendar-year return.

This data tells a compelling story. In 1987, during the infamous Black Monday crash, the S&P 500 fell 34%, yet the year closed with a 2% gain. In 2020, amid pandemic panic, the market dropped 34% intra-year before rallying to finish up 16%. Even in more difficult periods, like 2022’s 25% drawdown, the index did not end the year at its lowest point. The takeaway is clear: investors who maintain discipline and stay invested are often rewarded in the long run.

Why This Matters

Volatility is not a flaw in the system—it’s a natural part of how markets function. Periodic declines, even sharp ones, are to be expected. The differentiator among successful investors isn’t the ability to avoid downturns, but rather the ability to navigate them with purpose and perspective.

This is where a sound investment strategy becomes essential—one that is aligned with your long-term goals, your time horizon, and your unique tolerance (and capacity) for risk. Knee-jerk reactions to short-term events often lead investors astray, while a well-grounded plan keeps them moving forward.

A Moment for Reflection

The first quarter of 2025 tested many investors’ resolve, with the S&P 500 experiencing a 10% intra-year drop. The early weeks of the second quarter have brought continued volatility. And yet, as history reminds us, the discomfort of these moments is often temporary—while the rewards for staying the course can be lasting.

If recent market activity has caused you to question your approach, now is a great time to pause, reflect, and realign. A well-constructed portfolio should offer more than just returns—it should provide clarity in uncertain times and confidence across every phase of the market.

Reassess. Realign. Move Forward.

If the past few months have left you feeling uncertain—or simply more aware of the importance of a resilient strategy—this is the moment to take a fresh look at where you’re headed.

Whether you’re interested in rebalancing, refining risk exposure, or clarifying your long-term goals, our team is here to help. Because we believe true wealth is not measured by market returns alone, but by the life it allows you to lead.

Our mission is to help you Live Richly—and to explore the world your wealth makes possible.

Let’s start the conversation. Together, we can build a plan that withstands market fluctuations and supports the life you want to live—through every cycle.

Four Pillar Friday

Your weekly guide to thriving in every aspect of life—Physical, Mental, Spiritual, and Financial Wellness.

Four Pillar Friday

Your weekly guide to thriving in every aspect of life—Physical, Mental, Spiritual, and Financial Wellness.

Four Pillar Friday

Your weekly guide to thriving in every aspect of life—Physical, Mental, Spiritual, and Financial Wellness.