Insights Blog

Debunking Investing Myths

February 19th, 2025 // Michael Baker

Every investor has heard at least one “rule of thumb” that sounds too simple—or too ominous—to be true. Some of these “tried and tested” maxims come from decades of market folklore; others are simply repeated so often they start to feel like fact. In this post, we’ll debunk six common investing myths using historical data and a long-term perspective.

Myth 1: “Sell in May and Go Away”

What the Myth Says

This seasonal adage claims that stock markets underperform between May and October, implying that investors should sell their holdings in spring and buy back in autumn to avoid losses.

Why It Falls Short

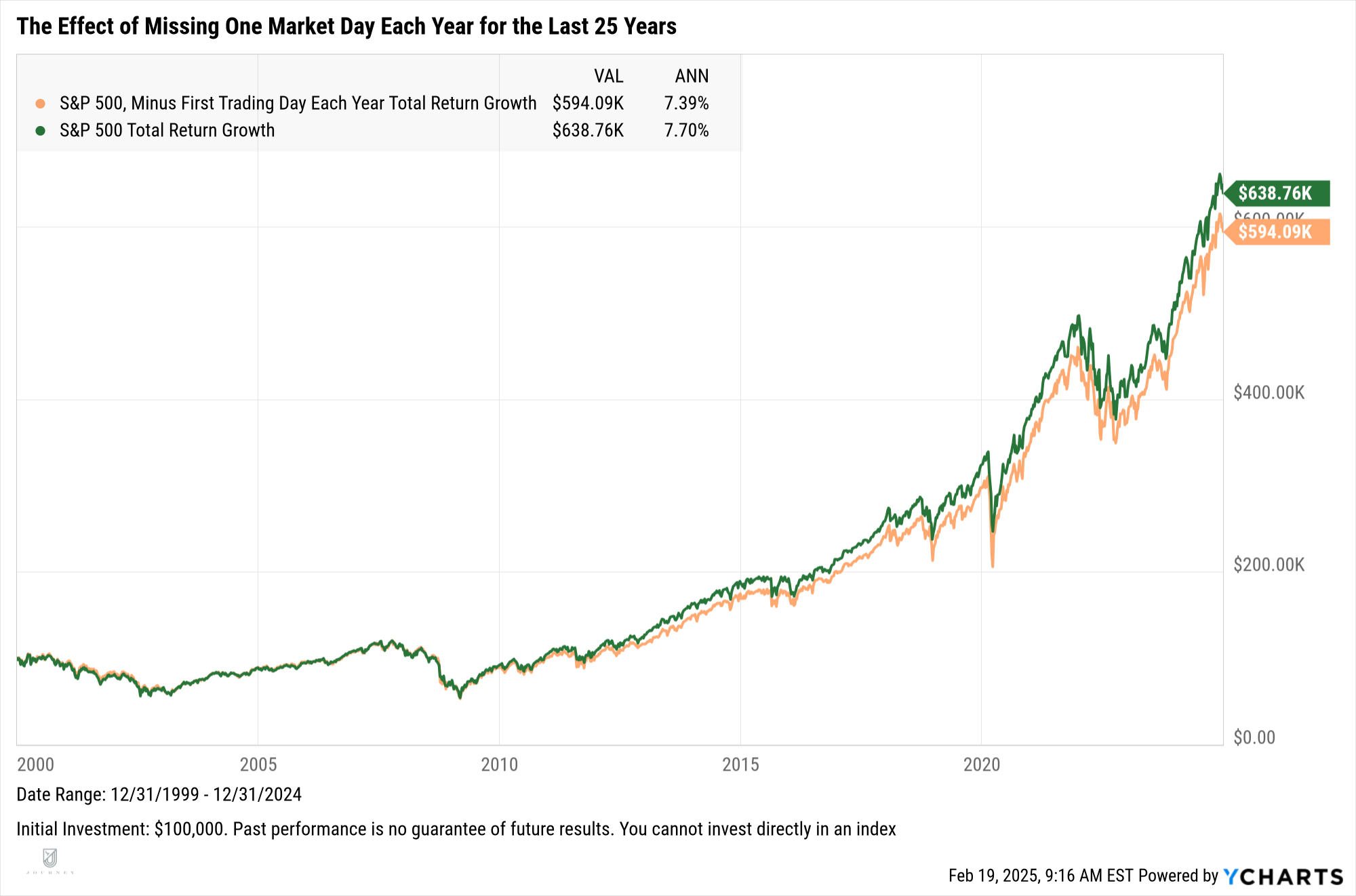

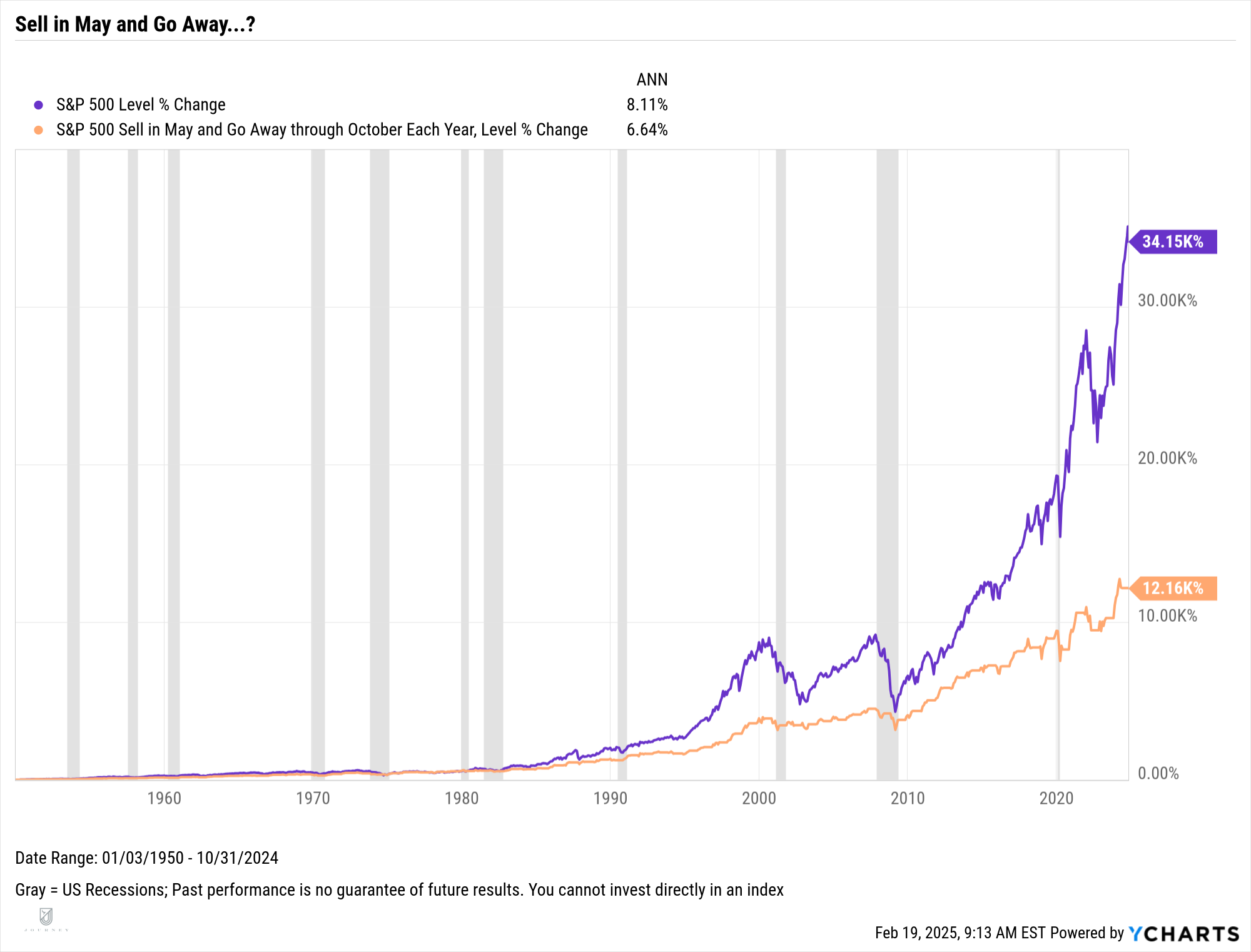

Historical data going back to 1950 shows that even the so-called “summer slump” months have contributed positively to overall market growth. A chart of average S&P 500 returns by month reveals that while September tends to be weaker on average, the combined period from May through October has still delivered meaningful gains over the long run.

Takeaway

Abandoning the market for nearly half the year often means missing out on rallies and dividends—both of which can seriously impact long-term performance. Instead of using calendar-based trading strategies, a steady, long-term approach usually wins out.

Myth 2: “Market Timing Is Important”

What the Myth Says

Many people believe the secret to successful investing is timing the market—selling at the peak, buying at the dip, and capturing only the “best” days of performance.

Why It Falls Short

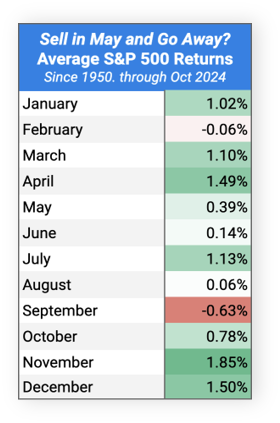

Data over the last 25 years shows that missing even a few top-performing days can drastically reduce returns. For instance:

- Staying fully invested in the S&P 500 delivered a 7.70% annualized return

- Missing just the 10 best days brought that down to 4.39%

- Missing the 20 best days: 2.40%

- Missing the 30 best days: 0.56%

- Missing the 40 best days: -0.91%

- Missing the 50 best days: -2.27%

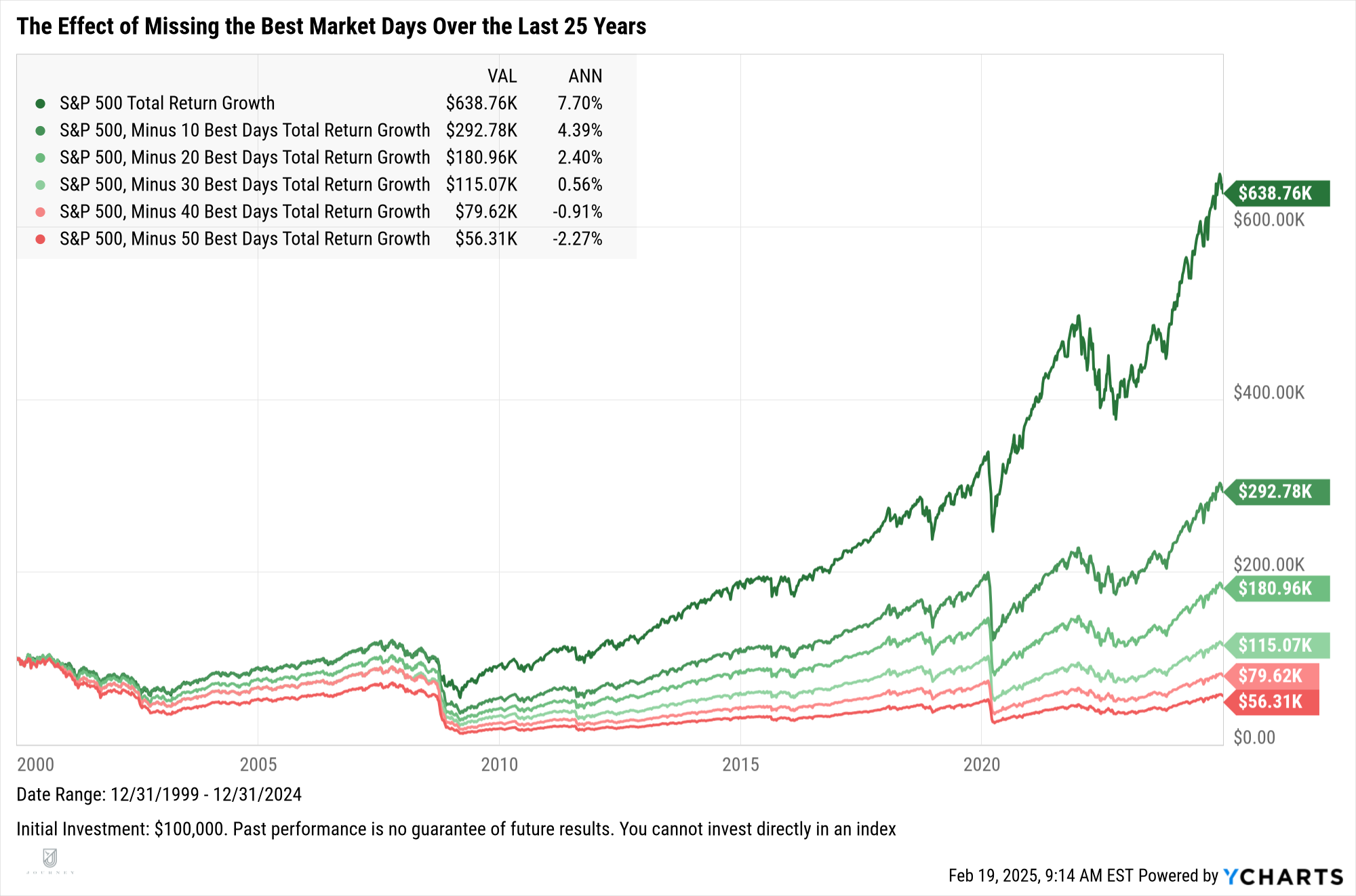

Even skipping one or two strong market days each year can compound to a big difference over decades. This underscores that “time in the market” often beats “timing the market.”

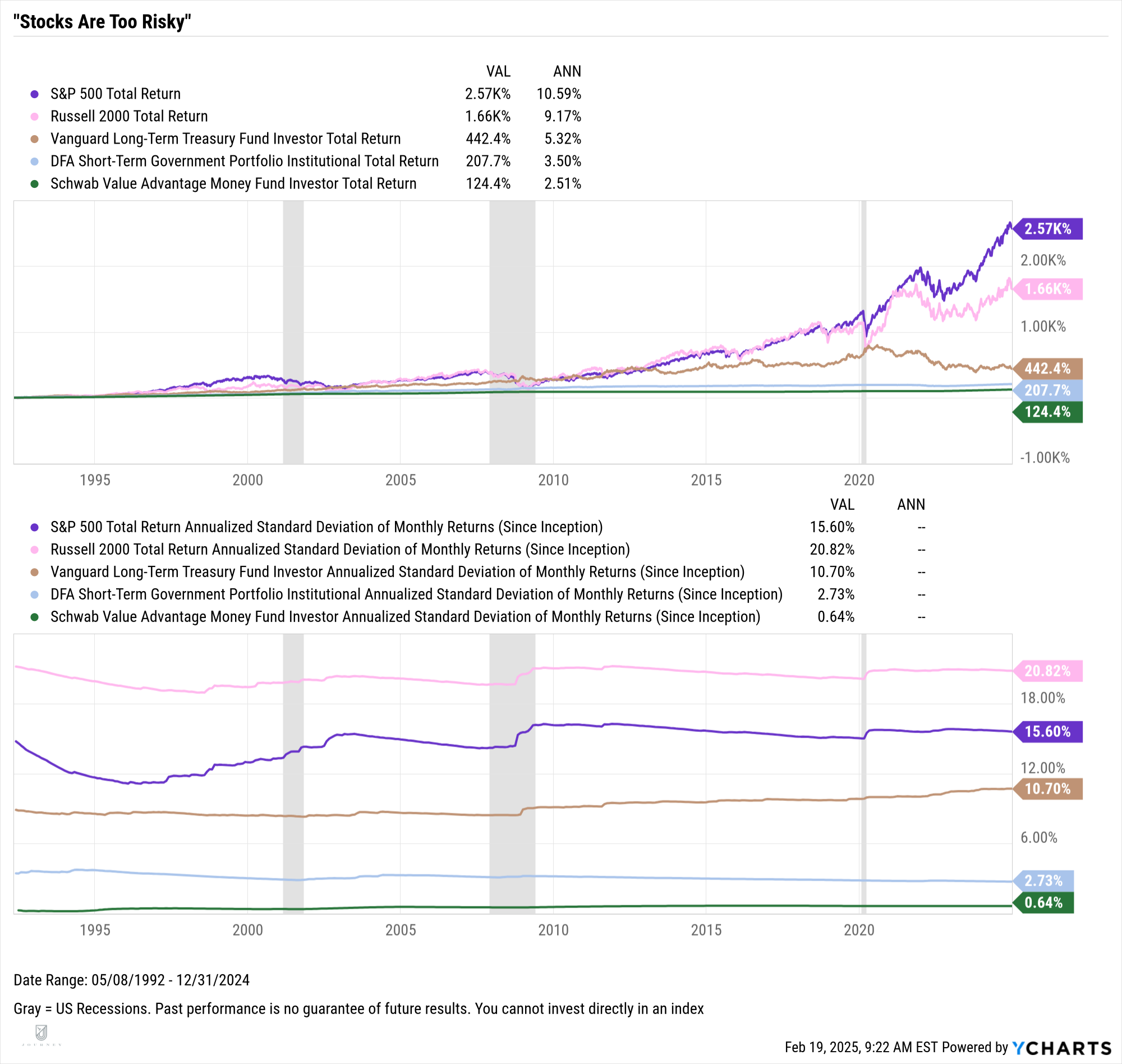

Myth 3: “Stocks Are Too Risky”

What the Myth Says

Stocks are volatile and prone to sudden drops, so they must be too risky for the average investor.

Why It Falls Short

Yes, stocks have higher volatility than bonds or cash. But that volatility is paired with higher potential returns. Historical standard deviation (a measure of volatility) for the S&P 500 is greater than that of long-term Treasuries. However, the S&P 500 has roughly double the annualized return compared to long-term bonds over the same period.

Takeaway

Over longer time horizons, equities have rewarded investors for taking on additional risk. While there are no guarantees, the potential upside of stocks has been significant—especially when blended with other asset classes in a balanced portfolio.

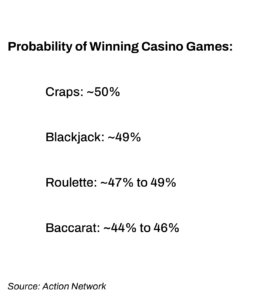

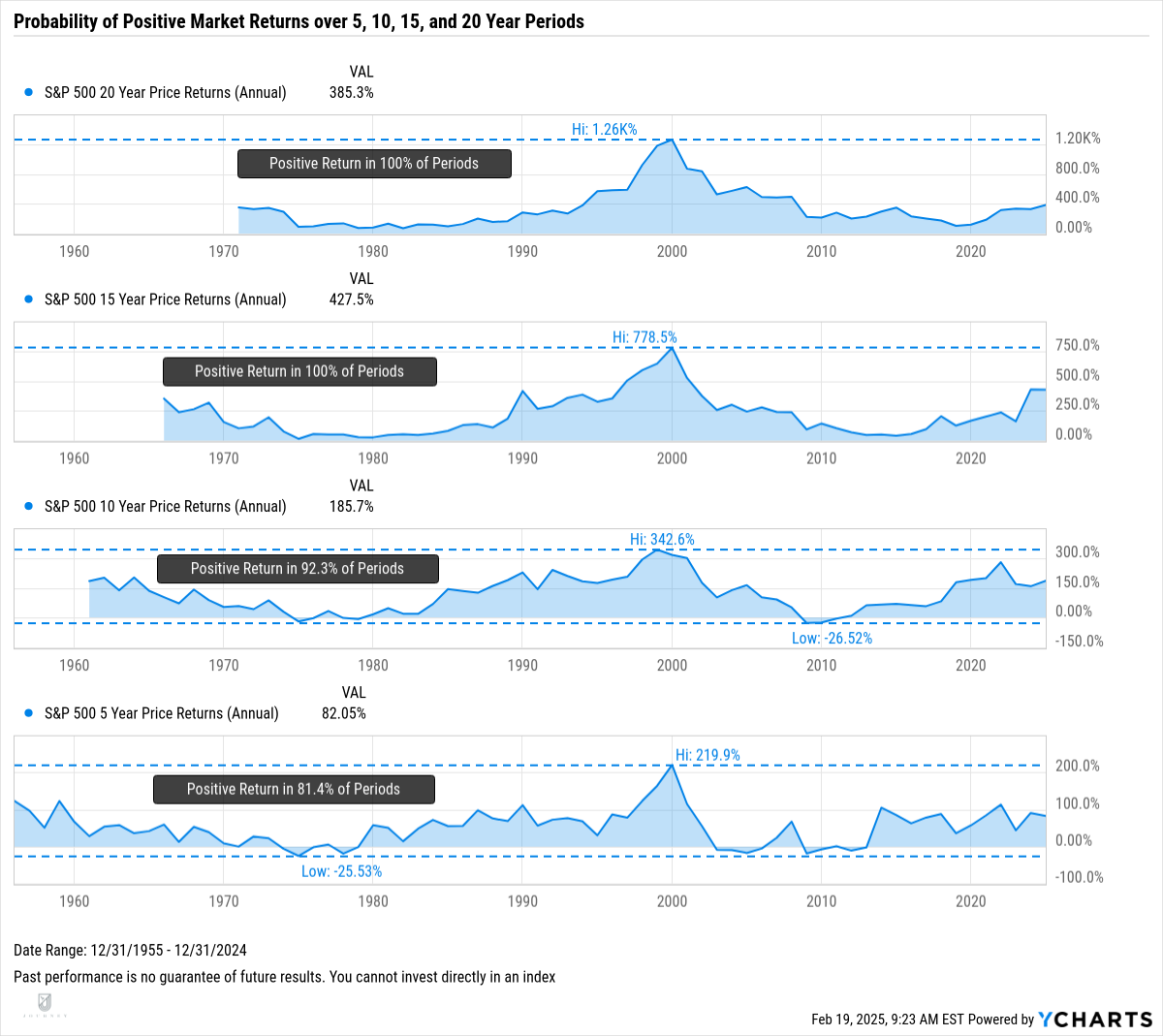

Myth 4: “Investing Is Like Gambling”

What the Myth Says

Some argue that investing in markets is no different from games of chance, claiming it’s essentially “placing bets” and hoping to win.

Why It Falls Short

Casino games like craps, blackjack, roulette, and baccarat inherently favor “the house,” with player odds often hovering around 44%–50% at best. Meanwhile, long-term data for the S&P 500 shows that holding stocks for 10, 15, or 20 years has consistently yielded positive returns in the vast majority of periods examined.

Takeaway

Investing is not purely a game of luck. While short-term market movements can feel random, long-term equity performance is driven by corporate earnings, dividends, and overall economic growth—not by the spin of a wheel.

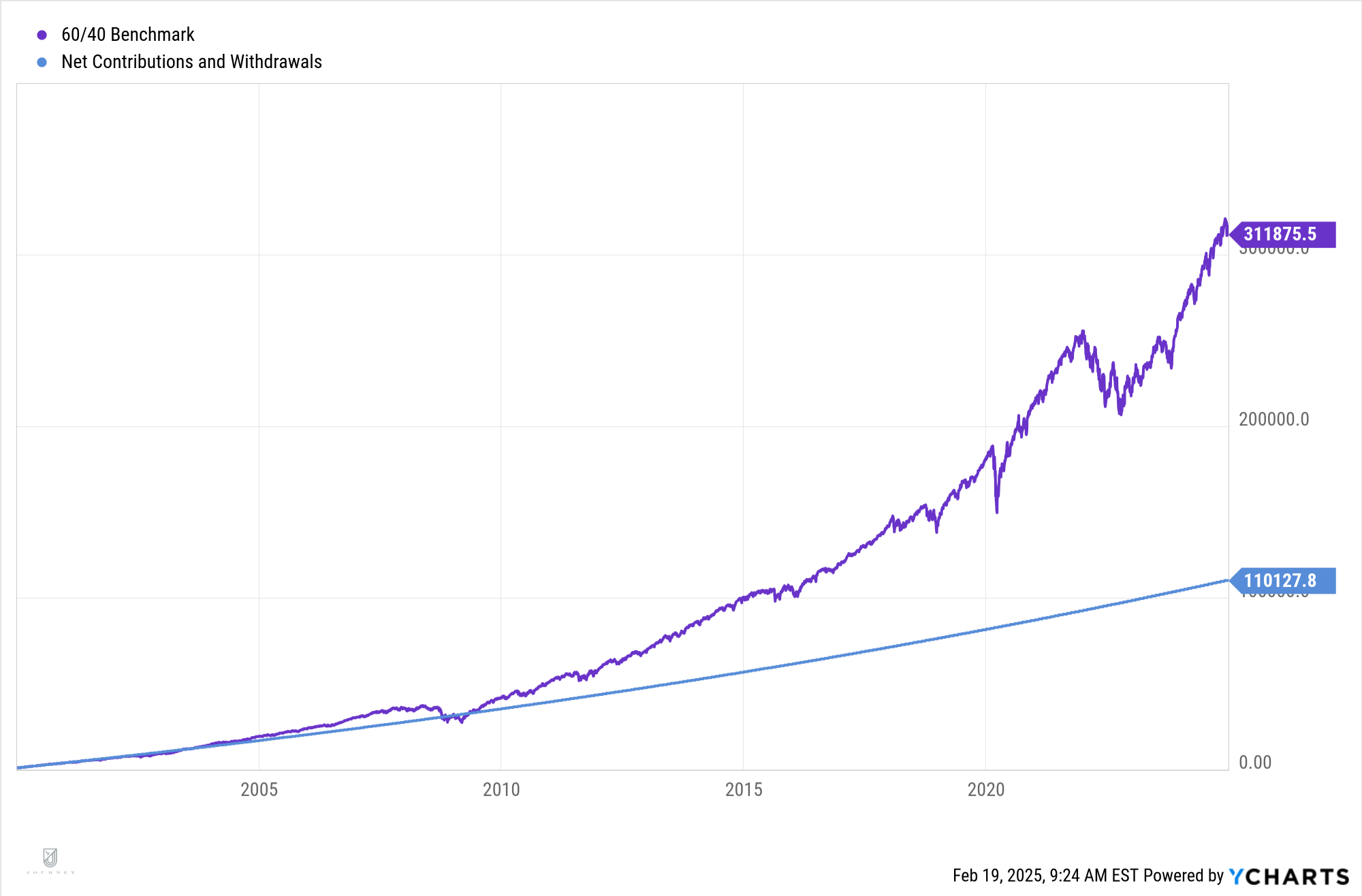

Myth 5: “Successful Investors Take Big Risks”

What the Myth Says

A common misconception is that big wins come only from big, concentrated bets—whether that’s a single “hot” stock or timing a sudden market spike.

Why It Falls Short

History has shown that a diversified, disciplined approach often leads to more stable long-term outcomes. For example:

- A hypothetical 25-year investment in a 60/40 stock/bond portfolio with regular monthly contributions (starting at $250 and increasing 3% each year) grew steadily and reached a substantial balance.

- In contrast, had someone invested a lump sum of the same total contribution ($110,128) into a single stock on January 1, 2000, their outcome varied wildly depending on the stock:

- Boeing ($728.78K current value after hitting a high of $1.772M)

- General Electric ($188.16K after a high of $218.76M)

- Citigroup ($32.30K after a high of $178.50K)

These dramatic ranges illustrate how concentration risk can make or break a portfolio. Most investors can benefit from consistent contributions to a diversified mix of assets, rather than rolling the dice on a single big bet.

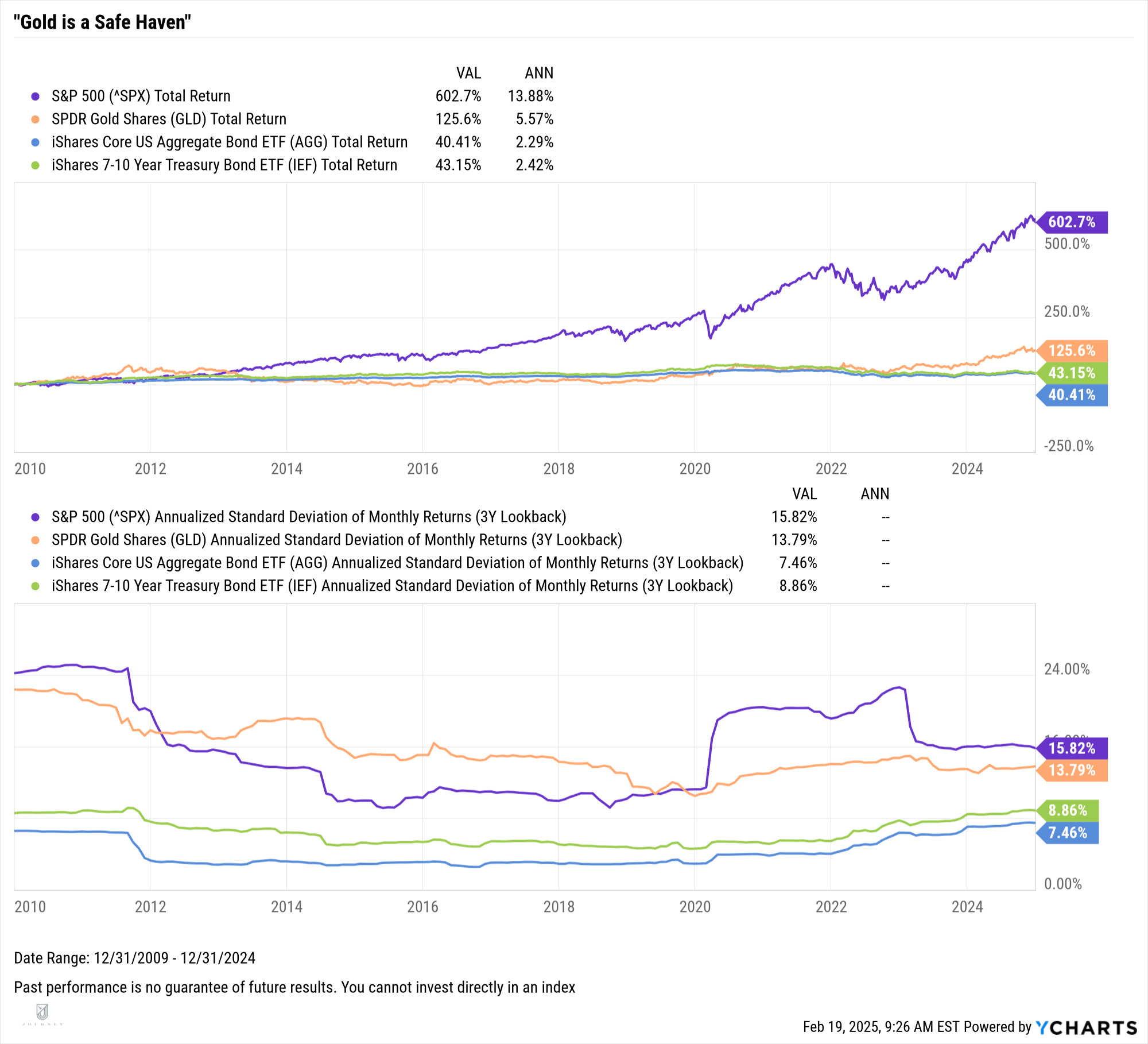

Myth 6: “Gold Is a Safe Haven”

What the Myth Says

Gold is often perceived as a reliable fallback during volatile times—a “safe haven” immune to stock-market storms.

Why It Falls Short

Recent data (since 2010) shows that SPDR® Gold Shares (GLD) delivered about a 5.6% annualized return—around 60% less than the S&P 500’s 13.9% in the same timeframe. Moreover, gold’s volatility (13.8% standard deviation) isn’t much lower than the S&P 500’s (15.8%). Essentially, investors took on comparable ups and downs but captured much smaller gains.

Takeaway

While gold may still play a small diversification role in some portfolios, it doesn’t automatically guarantee stability or growth. As with any asset, it’s prudent to weigh gold’s potential benefits against the rest of your holdings and your overall goals.

Final Thoughts

Many investing myths persist simply because they are repeated so often. But a closer look at the data suggests that:

- Seasonal strategies like “Sell in May and go away” rarely outperform consistent investing.

- Timing the market can cost you dearly if you miss just a handful of the best days.

- Volatility is not the same as “too risky”—stocks have rewarded long-term investors.

- Investing differs from gambling in that markets grow with the economy over time, whereas casino odds almost always favor the house.

- Diversification and consistency typically trump taking huge, concentrated risks.

- Gold can be volatile and doesn’t always provide strong returns or guaranteed safety.

The bottom line? A disciplined, well-diversified, and patient approach has repeatedly proven itself over reactionary, fear-based, or “get-rich-quick” strategies. By cutting through the myths and focusing on the facts, you’ll be better equipped to make sound investment decisions for your future.

Ready to move forward with a more informed investment strategy? Schedule a free consultation to learn how you can build a portfolio designed for long-term success.

Disclaimer: This post is for informational purposes and does not constitute personalized investment advice. Past performance does not guarantee future results. Always consult with a qualified financial advisor to determine the best investment strategy for your specific needs and circumstances.

Four Pillar Friday

Your weekly guide to thriving in every aspect of life—Physical, Mental, Spiritual, and Financial Wellness.

Four Pillar Friday

Your weekly guide to thriving in every aspect of life—Physical, Mental, Spiritual, and Financial Wellness.

Four Pillar Friday

Your weekly guide to thriving in every aspect of life—Physical, Mental, Spiritual, and Financial Wellness.