Insights Blog

Mid-Quarter Market Commentary

February 25th, 2025 // Jack LaLiberte

Market Recap

Although the election is now behind us, market participants still lack clarity on specific policy details. While shifting policy expectations can drive market volatility, it’s important to maintain focus on the bigger picture. Domestically, the soft-landing narrative seems to be unfolding, but inflation may remain more persistent than anticipated. With high valuations, particularly among the largest U.S. public companies, it’s crucial to ensure your portfolio is designed with a forward-looking perspective, rather than reflecting only recent return trends. On the fixed-income side, short-term rates appear to have stabilized as the Fed awaits further evidence of inflation-reduction. Future inflation expectations, along with the supply of government debt, will be key drivers of longer-term bond yields. While predicting the precise impact of policy changes is challenging, the combination of more restrictive trade policies and ongoing loose fiscal measures is likely to keep both inflation expectations and yields elevated compared to the past decade.

Looking Ahead

While the Fed and the market are fairly aligned in their expectations, fixed income markets are likely to remain somewhat volatile while the fiscal impacts of the new administration’s policies become clearer. However, higher yields insulate bond investors from interest rate risk and elevated equity valuations make bonds more attractive on a relative basis. Given the level of concentration within US equity markets, we believe that international, value and small-cap equities provide a critical element of diversification. We advocate building portfolios to achieve your long-term goals as opposed to trying to react to the latest headlines. Please don’t hesitate to reach out to your advisor to schedule time to discuss your financial plan, including your goals and planning assumptions.

Tariffs & Markets

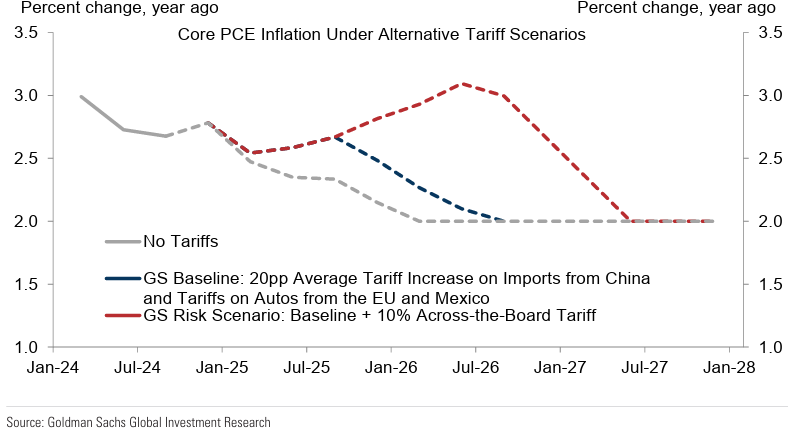

Many investors are evaluating the impact of the Trump administration’s policies on the economy and capital markets. It’s important to recognize that market performance isn’t typically tied to the political party in power. Long-term growth trends and demographic shifts are likely to have a far greater influence on future returns than any election outcome. While tariffs add complexity, companies have shown resilience by adjusting supply chains and passing costs onto consumers. Bond returns could be bolstered by the administration’s policies as long-term rates are expected to remain elevated. This benefits bond investors looking to lock in attractive yields but presents a challenge for consumers trying to finance long-term liabilities. Although the future of policy remains uncertain, the combination of tariffs and a limited political appetite for meaningful deficit reduction is likely to support inflation and maintain higher long-term yields. On the equity side, the increased policy uncertainty could result in more market volatility as investors adjust to evolving expectations.

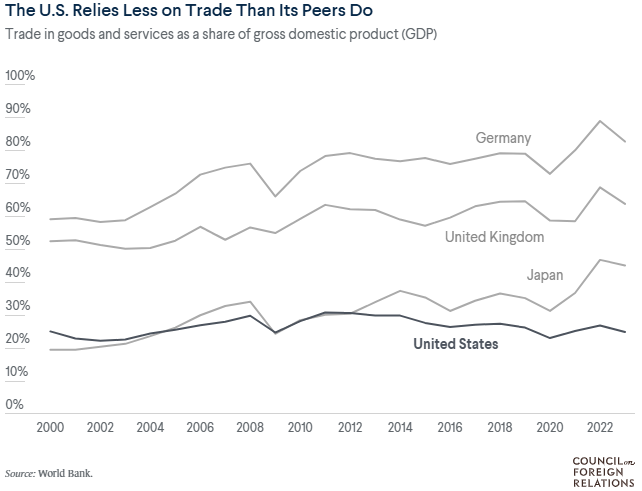

The proposed 25% tariffs on Mexican and Canadian goods are on hold until March 6th, pending further negotiations. However, an additional 10% tariff on Chinese goods went into effect in early February. Currently, China accounts for about 14% of total US imports, largely consisting of batteries, electronics and toys. As such, the impact of the current tariffs in place is likely to prove minimal. The recently announced tariffs on all steel and aluminum imports are likely to be more impactful. Vehicles and housing, two categories that have already seen substantial inflation in recent years, are likely to be the most affected by the recent metal tariffs. As of December 31, 2024, housing accounted for about 30% of current US inflation. An additional concern regarding tariffs is the second-order effect of retaliatory tariffs against US companies, which could hamper growth.

The impact of tariffs on equity markets is difficult to forecast, given the ever-changing proposals on the table. However, industrials and some consumer cyclical names are particularly susceptible to volatile trade dynamics. Financials are likely one of the sectors that is most insulated from tariff risk and were also one of the best-performing sectors in January. US equity markets have largely shrugged off tariffs to date, as earnings remain robust and companies have historically proven nimble in shifting supply chains and passing costs along to consumers. On the fixed income front, elevated inflation expectations, which are partially driven by tariffs, are likely to keep long-term yields elevated. A steeper yield curve is a hindrance to long-term borrowers, such as homebuyers, but could be an opportunity for fixed income investors.

Federal Reserve & Interest Rates

Federal Reserve & Interest Rates

The Fed kept rates steady in January following 100 bps of cuts in 2024. Futures markets are currently pricing in one to two rate cuts for 2025, though there’s a real possibility that no cuts will occur this year. Expectations for rate cuts have decreased in recent months as inflation concerns have resurfaced. Long-term rates have risen sharply since the Fed began its easing cycle, which may increase challenges for homebuyers but offer opportunities for fixed-income investors. Persistently high long-term rates could also crowd out corporate investment and consumer spending, potentially slowing long-term GDP growth.

While substantial improvement has been made on inflation over the past three years, further progress is likely to prove difficult. The Fed cut rates by 100 bps last year and appears likely to maintain the Fed Funds Rate at 4-4.25%, barring some credible progress on inflation. Since June of 2023, essentially no progress has been made on reducing inflation. The Fed’s current positioning, with a real rate of 1-1.25%, can hardly be considered overly restrictive. While the Fed maintains a neutral to marginally restrictive position, the Federal Government’s fiscal approach remains accommodative.

The Federal debt is currently just shy of 100% of GDP, the highest level since the aftermath of World War II. The CBO projects the deficit to remain near 7% of GDP annually in the coming years. While the Trump administration has paid lip service to spending cuts, their areas of focus are insignificant relative to the megalithic size of government spending. Currently, about 14% of government spending falls into the non-defense discretionary category that DOGE has focused on. The remaining 86% of the budget consists primarily of military spending, interest and welfare programs. The political appetite to address those more meaningful areas of spending has been lacking. So what does a continuation of loose fiscal policy mean for investors?

First, expect inflation to remain persistent, regardless of the Fed’s actions. Second, anticipate long-term rates to remain elevated. These rates are a product of future inflation expectations. A steeper yield curve makes fixed income investments more attractive relative to cash equivalents. Sustained elevated government deficits are likely to drive up borrowing costs for individuals and companies, crowding out investment at the margins and potentially contributing to slower long-term GDP growth expectations.

Fixed Income

Given the possibility of persistent inflation, we expect rates to remain elevated relative to recent years. Longer-term rates are driven by a variety of factors, but future inflation expectations are a significant input. As such, we recommend being selective in fixed income. There is a meaningful yield benefit in core fixed income relative to cash. Fixed income returns have shown a strong correlation with starting yields over the past five decades. While yields are attractive, we recommend an active approach, as passive bond indices are dominated by the issuers with the largest amount of debt.

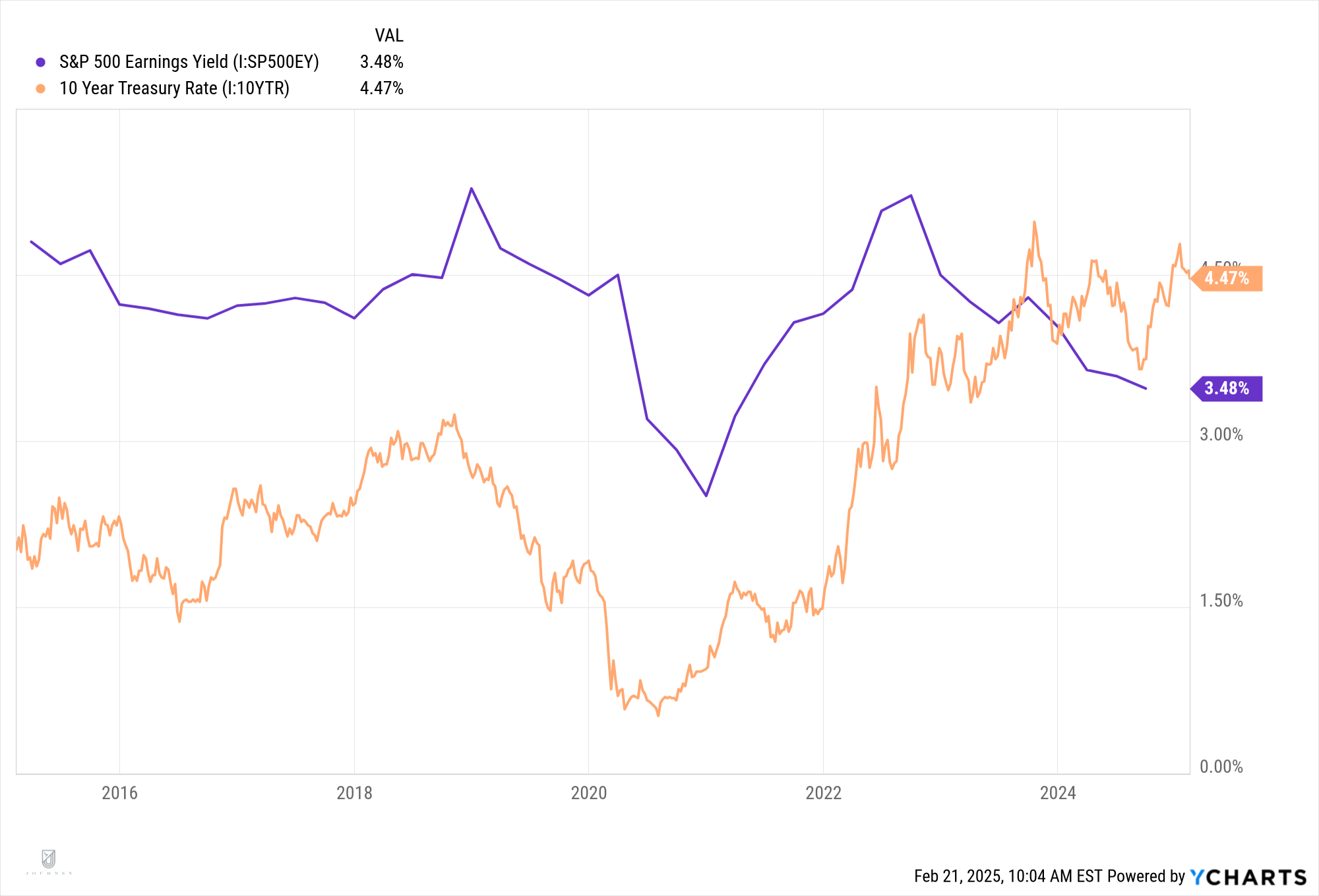

Interest rates and, by extension, fixed income markets, were volatile in 2024, with 10-year Treasury yields fluctuating between 3.6% and 4.8%. While volatility can be disconcerting, the bond market is a very different place than it was before 2022. Investors can now expect reasonable yields to compensate for taking interest rate risk. Investors don’t have to accept a yield discount to shift from cash equivalents to core fixed income and reduce reinvestment risk. While expectations for Fed cuts this year are low, the trend for short term yields is likely to be flat to slightly downward. A few years ago, bonds provided little yield and served primarily to mute volatility, whereas they now offer meaningful income as well as an avenue for capital appreciation. This shift, in conjunction with lofty US equity valuations, has meaningfully compressed the domestic equity risk premium.

While economic fundamentals are generally strong, corporate and high yield spreads are narrow relative to longer-term averages. Starting yields have historically been good predictors of longer-term future returns. Fixed income yields are currently substantially higher than they were prior to 2022. While inflation can hinder fixed income returns, the additional yield cushion should make sustained elevated inflation easier to withstand, particularly relative to cash.

As asset allocators, we’re constantly evaluating the relative attractiveness of various asset classes. On the equities front, valuations are the best predictor of long-term returns, analogous to yields in fixed income. In January, for the first time since 2003, the yield on the 10-year treasury surpassed the S&P 500 earnings yield (inverse of the PE ratio), making bonds all the more attractive relative to equities. There’s a substantial amount of noise around inflation expectations, the Fed and a myriad of other factors that promote yield curve volatility. However, the yields available in fixed income remain attractive, especially compared to cash equivalents and the elevated valuations on offer in equities.

Equities: Valuation & Concentration

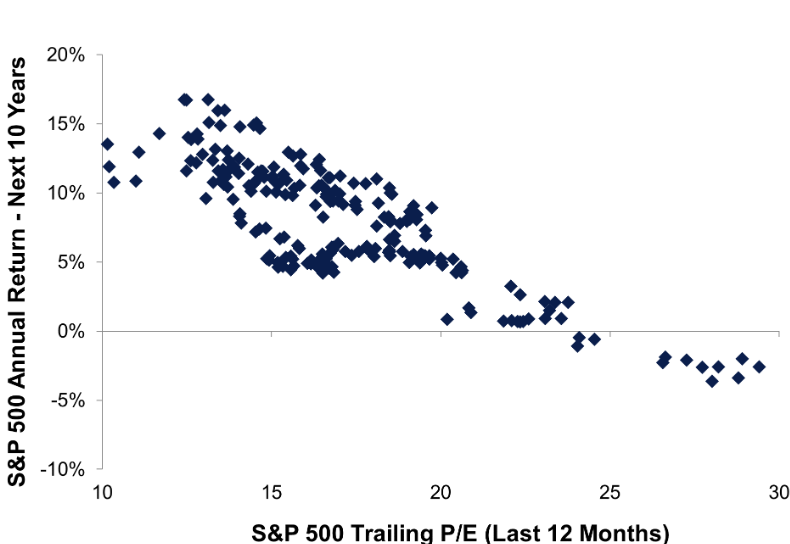

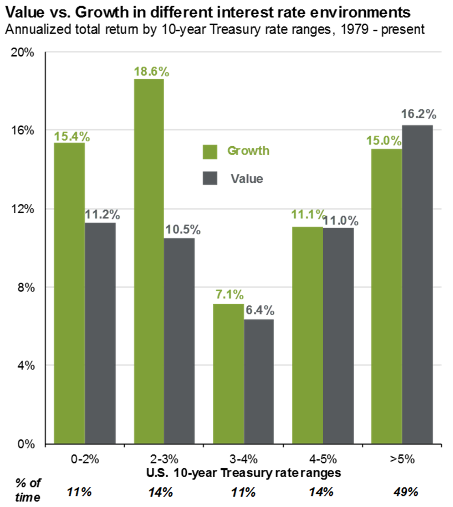

In January, we saw some reversion of the trends of the past few years, with Tech being the worst performing sector of the S&P 500. Concerns over the level of future AI investment rattled the sector. The S&P 500’s valuation remains well above the long-term average by nearly any metric. Historically, growth equities have meaningfully outperformed their value counterparts in periods where long-term interest rates are low. The valuation levels and highly concentrated nature of the S&P 500 could set up for substantial volatility if there is a shock to the growth outlook. We’d recommend reviewing your equity exposure and diversifying to less richly valued segments, including value, small-caps and international equities.

US Equity markets remain highly concentrated in a handful of names. While these large companies have driven a substantial portion of equity returns over the past five years, there’s no guarantee that that will continue. Many of these companies have significant growth expectations built into their current valuations. Even a minor reduction in AI investment or a weakening in consumer health could have a substantial impact on these large tech names.

While growth equities have outperformed their value counterparts over the past decade, growth equities haven’t historically outperformed in higher interest rate environments (10-year treasury above 4%). We don’t advocate eschewing US large cap equities in their entirety. However, we firmly believe in the prudence of diversification as well as the fact that valuations matter. The S&P 500 has not experienced positive 10-year subsequent returns when the starting valuations are as elevated as they are today. In addition to lofty valuations, ten companies now account for nearly 40% of the S&P 500’s market cap. There are several areas, including small cap domestic equities as well as international equities, where valuations are nearer to their historical averages and there is less concentration present.

Political Volatility & Markets

The 2024 election was different than many past cycles. On average, election years tend to feature more volatility and lower returns than non-election years in the months leading up to the election. After elections, markets tend to rally as uncertainty wanes. 2024 was very much the opposite, with markets performing strongly in the first half of the year and more muted equity performance in the second half, accompanied by a jump in interest rates that tarnished what would’ve otherwise been a solid year for fixed income. The moves we saw in fixed income towards the end of last year stem from the market’s belief that the Trump administration’s policies are likely to prove inflationary. Given the rhetoric around tariffs and the lack of impetus to slow government spending in a meaningful way, inflation is likely to remain stubborn in the short to intermediate term.

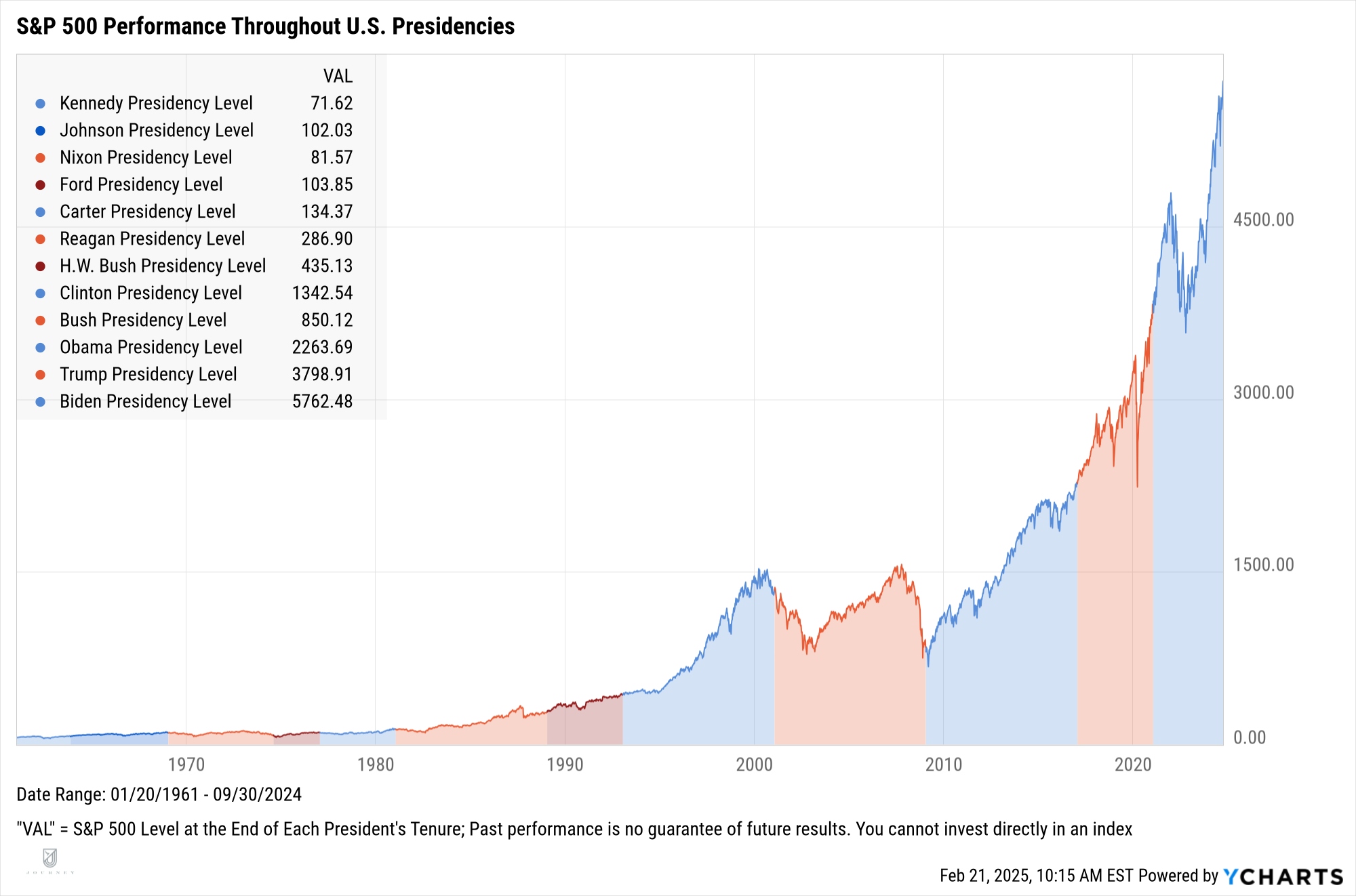

In 2025 thus far, we’ve seen more volatility than in 2024. Using the VIX, a measure of market volatility, as a guide-post, 2024 was the least volatile year for the S&P 500 since at least 2020. As such, investors are likely much more sensitive to what are historically unremarkable levels of volatility. Some investors have expressed concerns regarding recent executive branch initiatives around government agencies. While the executive branch has a wide level of discretion within these agencies, that power isn’t without limits. These agencies were authorized and funded by Congress, who then delegates authority for management to the executive branch. While there’s a lot of bluster around the executive branch’s role in spending, the executive branch can’t indefinitely withhold funds or dissolve agencies authorized by Congress. While the uncertainty around what course the administration will take could be concerning, we think it’s important to not get too caught up in the day-to-day noise. The government’s choices have some impact on markets. However, markets are complex engines that digest a lot of information and bureaucratic choices are just one element of that. Historically, which party controls the White House is insignificant for markets. In the past four administrations (the two Obama terms, Trump’s first term and the Biden administration), the S&P 500 has returned at least 40% in each four-year presidential term.

At the end of the day, no one knows what the administration will elect to do in the coming months and for long-term market returns, it may not matter. We believe that remaining fully invested in all political environments, in line with your personal financial plan, is critical to compounding returns over long horizons. While it may be tempting to sit on cash during periods of uncertainty, the return drag of cash relative to other asset classes is meaningful over time. This is particularly true during periods where inflation remains elevated, as could be the case if a cycle of tariffs and retaliation comes into effect. As always, if you have market concerns, please reach out to your advisor to discuss those concerns and the potential impact on your personal financial plan.

What it All Means

- Equity Valuations: US Equity markets remain highly concentrated in a handful of names. Valuations, particularly for the largest US companies, are above historic norms, indicating that a substantial amount of growth may already be priced in. If your portfolio looks like the S&P 500, you may be more exposed to volatility than a more diversified allocation that includes international and small-cap equities. These segments also sport valuations that are nearer to their historical averages than those of US large cap equities.

- The Fed & Fixed Income: Since last summer, very little progress has been made on inflation reduction. The market now expects just one Fed rate cut this year. Long-term yields are driven by dynamics in the Treasury market as well as inflation expectations. Both of those trends point towards sustained higher yields. Long-term rates sit at attractive levels, relative to cash yields and equity valuations. We recommend maintaining an active approach within fixed income, as passive indices tend to place the heaviest weights on the largest issuers of debt.

- Tariffs & Markets: The long-term impact of tariffs on equity markets is difficult to forecast, given the ever-changing proposals on the table. However, industrials and some consumer cyclical names are particularly susceptible to volatile trade dynamics. Financials are likely one of the sectors that is most insulated from tariff risk. US equity markets have largely shrugged off tariffs to date, as earnings remain robust and companies have historically proven nimble in shifting supply chains and passing costs along to consumers.

- Political Volatility & Markets: The political party that holds the White House has little predictive power over equity returns. No one knows what the administration will elect to do in the coming months and for long-term market returns, it may not matter. Remaining fully invested in all political environments, in line with your personal financial plan, is critical to compounding returns over long horizons. While it may be tempting to sit on cash during periods of uncertainty, the return drag of cash relative to other asset classes is meaningful over time, particularly in periods of elevated inflation.

Relevant Disclosures: This information was prepared by FSM Wealth Advisors, LLC d/b/a Journey Wealth Management, LLC (“Journey”), a federally registered investment adviser under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply a certain level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. Journey’s Form ADV Part 2A and Part 2B can be obtained by written request directly to: 22901 Millcreek Blvd., Suite 225, Cleveland OH 44122.

The information herein was obtained from various sources. Journey does not guarantee the accuracy or completeness of information provided by third parties. The information provided herein is provided as of the date indicated and believed to be reliable. Journey assumes no obligation to update this information, or to advise on further developments relating to it.

Investing involves the risk of loss and investors should be prepared to bear potential losses. Past performance is not indicative of future results. Neither the information nor any opinion expressed herein should be construed as solicitation to buy or sell a security or as personalized investment, tax, or legal advice. For advice specific to your situation, please consult an appropriately qualified professional investment, tax or legal adviser.

Four Pillar Friday

Your weekly guide to thriving in every aspect of life—Physical, Mental, Spiritual, and Financial Wellness.

Four Pillar Friday

Your weekly guide to thriving in every aspect of life—Physical, Mental, Spiritual, and Financial Wellness.

Four Pillar Friday

Your weekly guide to thriving in every aspect of life—Physical, Mental, Spiritual, and Financial Wellness.